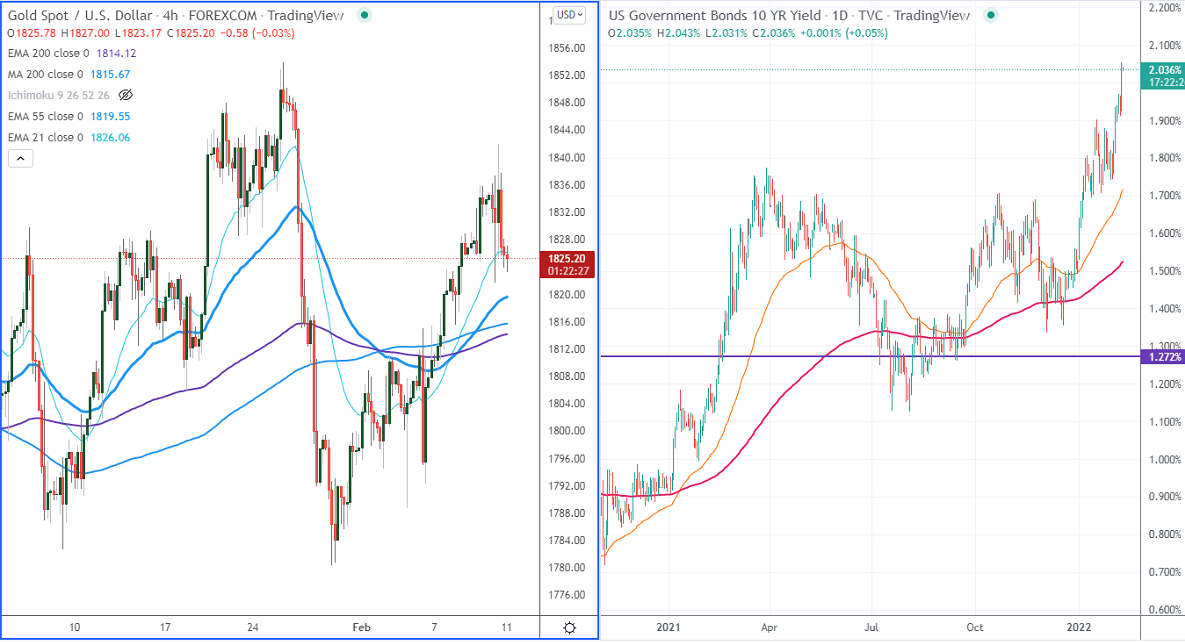

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1830.79

Kijun-Sen- $1831.85

Gold lost more than $20 after upbeat US inflation numbers. The January US CPI came at 7.5% YoY vs forecast of 7.3%, the highest level since Feb 1982. US 10-year yield surges past 2% for the first time since Aug 2019. The US dollar index has formed double bottom around 95 and jumped more than 100 pips. Gold hits a low of $1821 and is currently trading around $1823.88.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1820, violation below targets $1810/$1800/$1770/$1750. Significant reversal only below $1750.The yellow metal faces strong resistance of $1840, any violation above will take to the next level $1853/$1860/$1877/$1912 is possible.

It is good to sell on rallies for $1834-35 with SL around $1851 for TP of $1780.