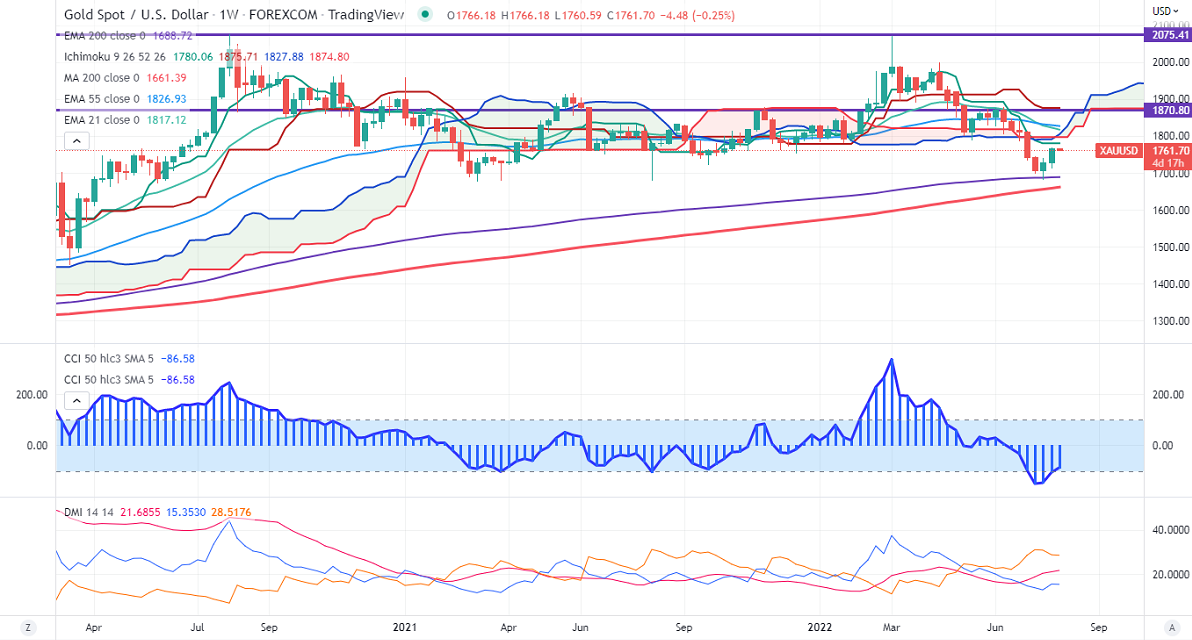

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $1726.96

Kijun-Sen- $1875.71

The gold price was among the top performers the previous week due to the dovish Fed rate hike. The central bank hiked interest rates by 75 bpbs for the second consecutive month since 1980 and said that recent indicators of spending and production have "softened". According to the fed, the job market remains robust and inflation remains elevated. The committee will monitor the implications of incoming information for the economic outlook. US dollar index trading weak for a third consecutive week and lost nearly 200 pips on board-based US dollar selling. Sell-off in US treasury yields also supported the yellow metal at lower levels and pared most of its gains after the dovish US fed policy. According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Sep rose to 70.5% a week ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish(Negative for gold)

US10-year bond yield- Bearish (Negative for gold)

Technical:

The near–term support is around $1745, a breach below targets $1720/$1700/$1680.Significant reversal only below $1600. The yellow metal faces minor resistance around $1770, breach above will take it to the next level of $1790/$1803.

It is good to buy on dips around $1750 with SL at $1730 for TP of $1800.