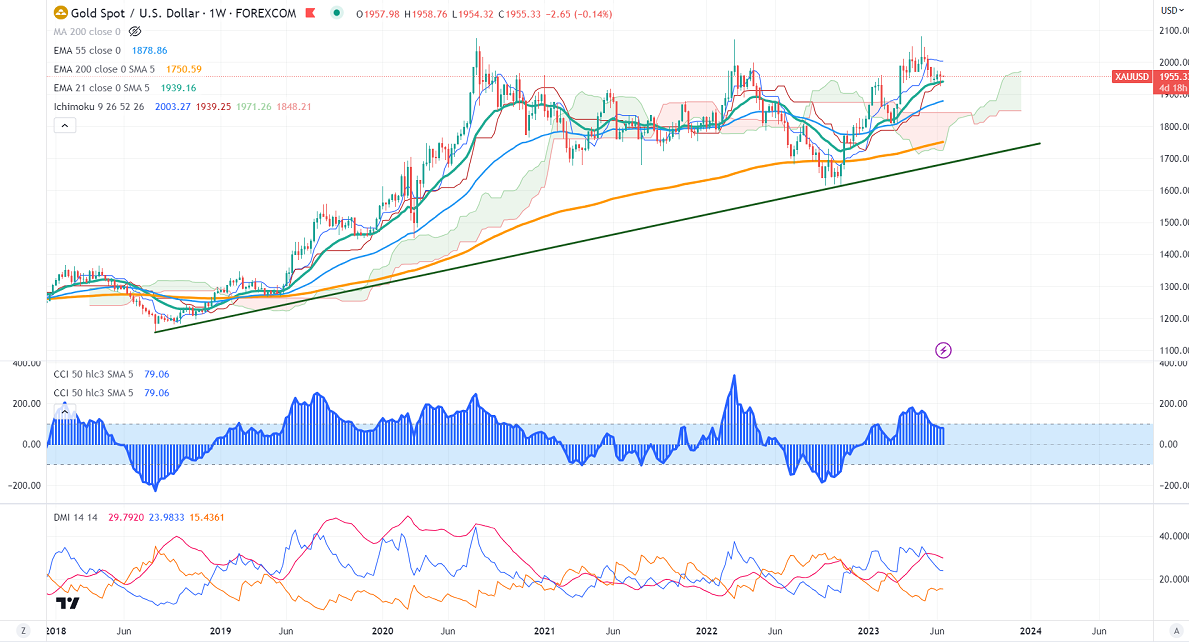

Ichimoku Analysis (Weekly chart)

Tenken-Sen- $2003.27

Kijun-Sen- $1932.90

Gold prices recovered sharply on Friday due to mixed US economic data. It hits a high of $1967.95 and is currently trading around $1955.59.

Major Central Bank policies-

ECB hiked rates by 25 bpbs to 3.50%, the highest level since 2001. The US Fed has kept its rates unchanged as expected at 5.25%. The central bank has projected the median federal funds rate from 5.1% to 5.6% (three more 25 bpbs rate hikes in 2023). For 2024 it increased from 4.3% to 4.6%.

US core CPI rose 4% in May from 4.9% in Apr, the lowest level since Mar 2021 in Apr. US May inflation rate at 0.10% (MoM) Vs. Est 0.30%.

US retail sales rose 0.30% in May, compared to an estimate of -0.20%. Core sales, excluding automobiles, gasoline, and building materials rose 0.20%. NY Fed Empire state manufacturing index jumps to 6.6 in June vs. -15.1 expected

US dollar index- weak. Minor support around 102/101. The near-term resistance is 103/103.85.

Major economic data for the week

Jun 21st, Fed Chairman Powell testifies (2 pm GMT)

SNB monetary policy Assessment (7:30 am GMT)

June 22nd, MPC official bank rate (11 am GMT)

US existing home sales (2 pm GMT)

June 23rd, Flash manufacturing PMI (1:45 pm GMT)

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 71.9% from 52.8% a week ago.

The US 10-year yield pared some gains after mixed US economic data. The US 10 and 2-year spread widened to -94% from -35%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bullish (Bearish for gold)

Technical:

The near–term support is around $1935, a break below targets of $1925/$1900.The yellow metal faces minor resistance around $1965, and a breach above will take it to the next level of $1980/$2000/$2020/$2040/$2070/$2100/$2150.

It is good to sell on rallies around $1960-61 with SL around $1975 for TP of $1920/$1900.