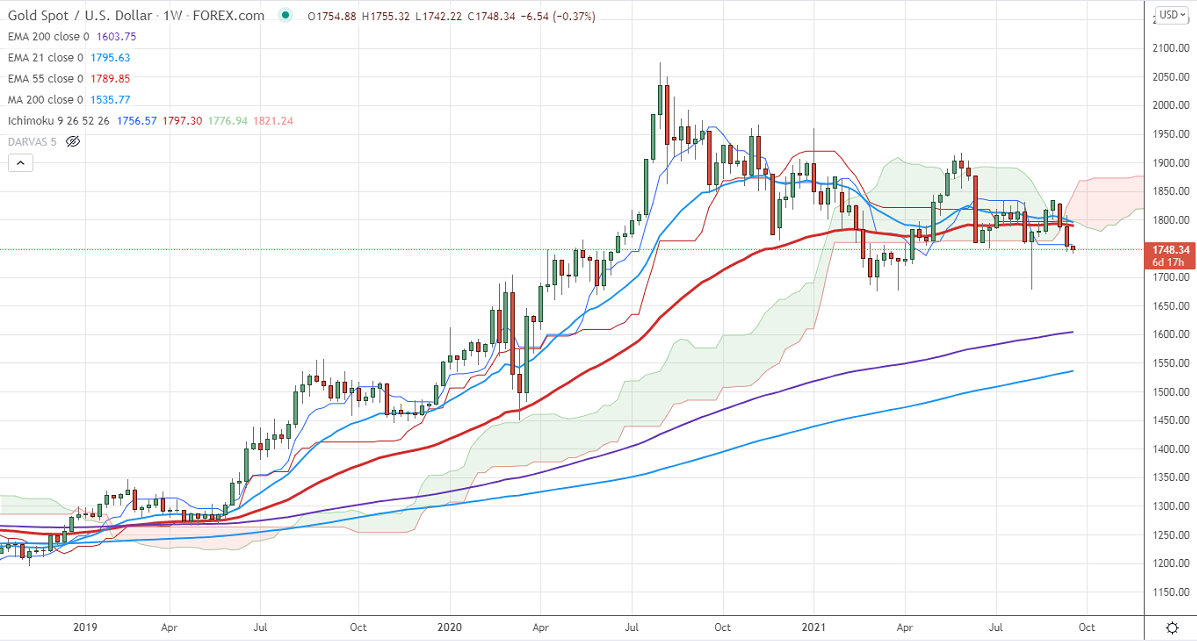

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1756.57

Kijun-Sen- $1797.30

Gold is the trading week for the third consecutive week and lost nearly $90 on board-based US dollar buying.DXY is holding above 93, any breach above 93.75 confirms further bullishness. The yellow metal hits a low of $1742 and is currently trading at around $1748.

Economic data-

The US inflation rose by 0.3% in August compared to a forecast of 0.4%. The headline CPI for the year jumped to 5.3%, in with expectations. While retail sales jumped by 0.7% in Aug compared to an estimate of -0.7%. The number of people who have filed for unemployment benefits jumped by 20000 to 332000 for the week ended September.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1770 and a convincing break above will take the yellow metal $1787/$1800 if possible. It is facing strong support at $1740, violation below targets $1$1725.

It is good to sell on rallies around $1754-55 with SL around $1770 for TP of $1675.