The gold (XAUUSD) has been spiking through rising wedge pattern which is bullish in nature, you could see bears popping up at wedge resistance with back-to-back shooting stars formations (see the circled area on weekly plotting).

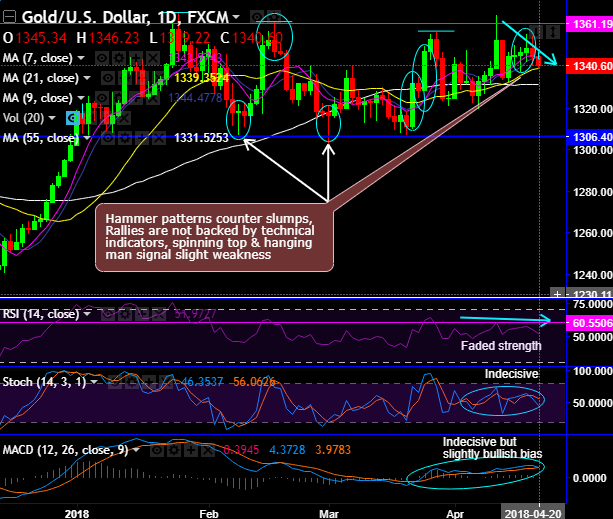

The intermediate trend has been stuck in the tight range between $1,361 and $1,306 levels. The hammer and bullish engulfing patterns have occurred in between these ranges to intensify rallies (on daily terms).

Hammer at 1318.71 and 1316.84 levels and bullish engulfing patterns at 1332.05 and 1347.73 levels

These bullish patterns have occurred at strong range support levels, but this cannot be isolated as stern bulls rallies as RSI, and stochastic curves have been indecisive and MACD on the other hand also signals indecisiveness, bullish bias though.

Despite the bullish DMA crossover, the prices are stuck between 7DMA and 21DMA as RSI and stochastic doesn’t confirm bullish momentum convincingly.

On a broader perspective, we must appreciate the bullish strength of this precious metal price as the intermediate trend has been spiking through rising wedge pattern, and especially after the strong test of support at around $1306 mark, on the flip side, bears resume exactly at rising wedge resistance (refer weekly plotting).

As you could make out that the price has been oscillating between 1365 and 1306.40 levels since 3rd January.

Hence, long-term investors should wait and watch out closely for decisive breach below 1365-68 levels with a wise hedging.

Well, at spot reference: $1,340.90 levels, in order to participate in prevailing selling interests, we advocate buying tunnel spreads which is a binary version of the debit put spread, use upper strikes at 1346 and lower strikes at 1331.500 levels.

Alternatively, with a view to arresting potential upside risks, we advocate buying futures contracts of far-month tenors.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?