Technical Inference:

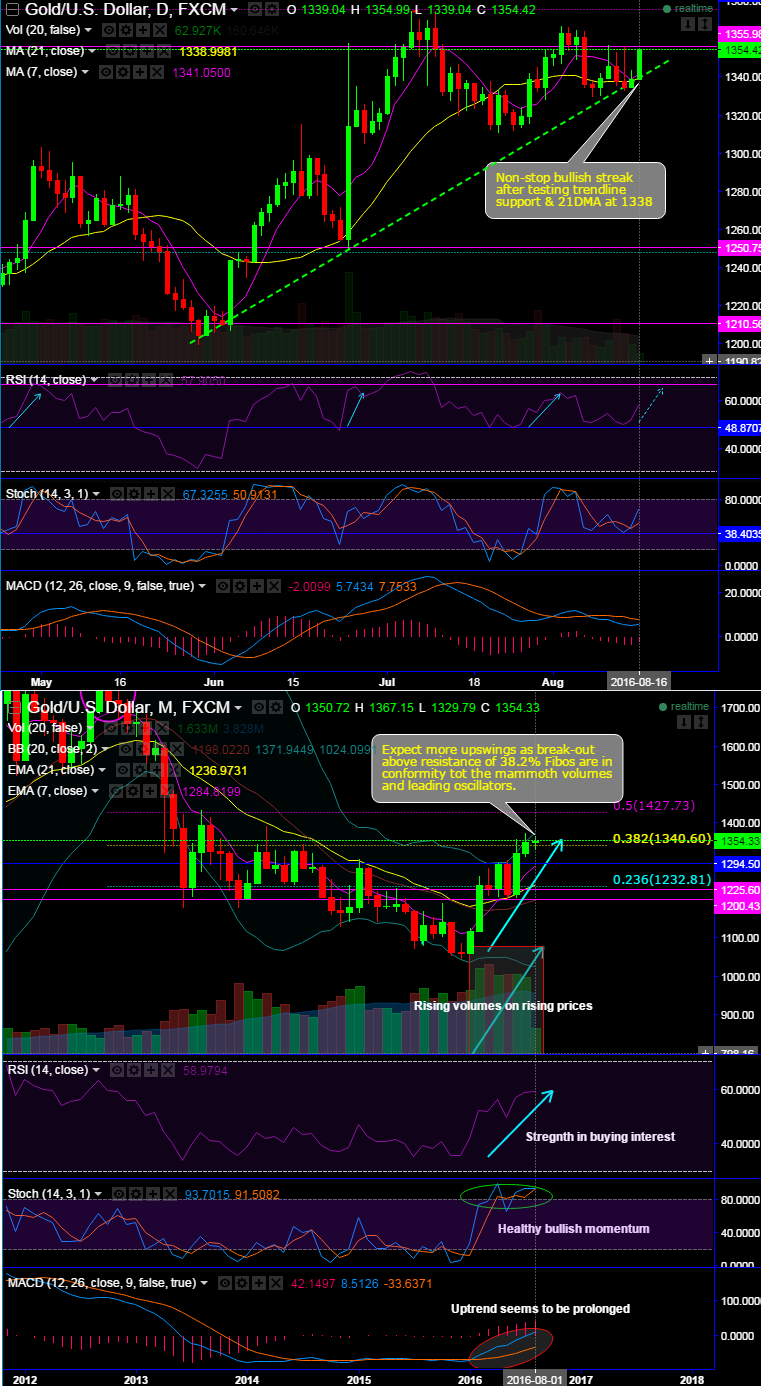

Gold prices resume non-stop bullish streaks soon after testing trend line support & 21DMA at 1338.

Expect more upswings as break-out above resistance of 38.2% Fibos are in conformity tot the mammoth volumes and leading oscillators.

Please be noted that the current prices have again spiked well above DMAs on daily charts, the current prices have jumped above EMAs as well on monthly charts.

Currently, heading towards next resistance at 1355.98, if it break and sustains above that level then we could foresee dragging prevailing upswings to retest recent highs 1367 and 1375 marks.

Daily RSI has been converging upwards with healthy rallies ever since it has taken support at bottom-line at around 48 levels, strength in buying interest is observed even monthly terms.

On a broader perspective, the precious metal hasn't been able to trade near multi-months highs (at around 1275 mark) (see monthly charts).

To substantiate, it has shown a considerable jump from last 2-3 months that has taken the current prices above 7 & 21EMAs along with robust volumes and the convergence shown by leading oscillators and MACD has triggered off bullish environment, which means even though the prices were seeing little skepticism at 1375 and 1386 zones, the major trend is most likely to encompass medium term uptrend with short-term obstacles.

Trade tips:

Intraday speculators can eye on boundary binaries keeping 1355.98 upper bracket and 1346 as the lower bracket. Gold for December delivery on the Comex division of the NYME nailed on $7.25, or 0.54%, to trade at $1,354.75 a troy ounce by 06:50GMT. On the delivery basis, one can go long in mid-month futures for northward targets of 1384 and 1400 in the days to come.