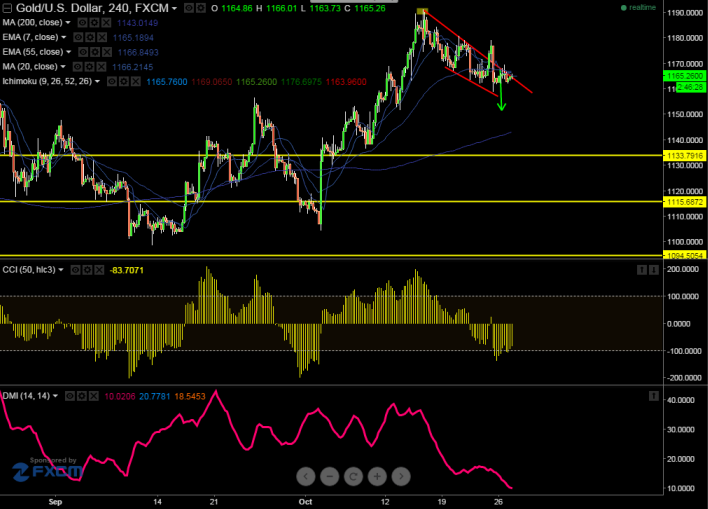

Gold has made a high of $1179 and retreated from that level. Overall trend is still weak as long as resistance $1180 holds.

- Any break above $1180 will take the commodity to next level $1190/$1195.

- On the downside major trend line support is around $1156 and break below targets $1141/$1135 in short term.

- Overall bearish invalidation only above $1190.

It is good to sell on rallies around $1167-70 with SL around $1180 for the TP of $1141/%1136