Stay long Feb'17 CME gold Following the December Fed hike, macro markets broadly reacted meaningfully to the more hawkish rate projection, with gold specifically selling off to $1,213/oz. This price level for gold made us take pause.

Granted, there are risks that the bottom in price could be similar to that reached in 2015 if real yields raise another 50 basis points; however, some of the assumptions one has to make to get us there look farfetched.

We concluded that gold’s near-term selloff may be approaching an end given the severity in the post-hike moves in both the USD and S&P 500 and the magnitude of the sharp rise in yields.

While the potential for a further near-term boost in yields and the possibility for further ETF liquidation pose near-term risks, we recommended going long the Feb'17 CME gold contract.

Initiate longs in CME gold for February delivery at a price of $1,191.50/oz on December 16, 2016. Trade target is $1,240/oz with a stop at $1,075/oz.

Alternatively, option trade plans are also devised as follows:

OTC outlook:

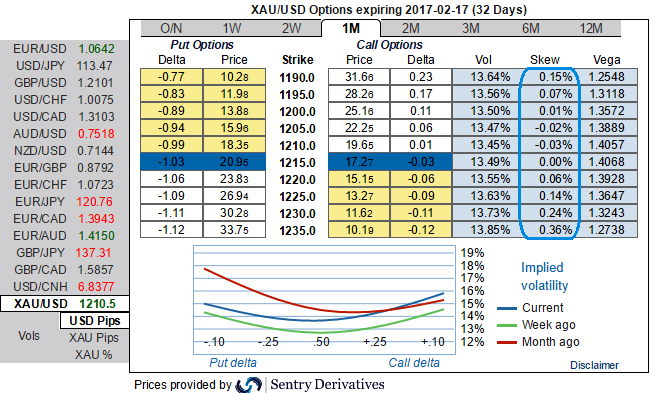

The current implied volatility of XAU/USD ATM 1w contracts are at 13% with skews signifying hedgers interests are in well balanced on either sides but slightly biased towards OTM call strikes, and it is likely to spike higher for 1m tenors.

While delta risk reversals substantiate these figures with upside risk sentiments (observe positive shifts across different tenors). By this we mean guaranteed hedge at the higher strike (worse than the outright forward rate if unleveraged) in order to benefit from a favorable market move down to the lower strike.

Hedging Strategy: Option straps (XAU/USD)

As the risk reversal numbers allow for a customized hedging solution, tailored to your risk and hedging profile contemplating both side risks. Risk Reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Nonetheless, usual margin requirements still apply. Usually, Risk Reversals are structured as zero premium hedging solutions.

Hence, we recommend deploying hedging strategies to arrest upside risks with longs positions in 2 lots of 0.51 delta ATM calls with 1M expiry and 1 lot of -0.49 delta ATM puts of 2w expiries.

Subsequently, this XAUUSD option straps strategy would take care of ongoing upswings and abrupt downswings and yields handsome returns.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty