The speculators are advised to book profit on long Feb'17 CME gold that we had advocated in the recent past reflecting the US political agenda ahead after Trump’s oath ceremony, gold had a bit of a topsy-turvy day, declining nearly 1% in the New York morning before recovering and settling close to 1% up on the day. We initially recommended going long the Feb'17 contract in mid-December as gold's sell-off to $1,130/oz following the December Fed hike made us take pause.

At that time, we concluded that gold’s near-term sell-off may be approaching an end given the severity in the post-hike moves in both the USD and S&P 500 and the magnitude of the sharp rise in yields. Since then, while the trade-weighted USD and the S&P 500 have largely stayed elevated, US yields have retreated off their mid-December highs and gold prices have simultaneously increased more than 5%.

Given the looming, largely uncertain, catalyst of the US inauguration and the launching of the first 100 days of Trump’s presidency we decided to lock in our gains and close our position at today’s settlement price, simultaneously, we follow risk on and risk off (RORO) in bullion markets owning the hedging vehicle via below option strategy.

OTC outlook:

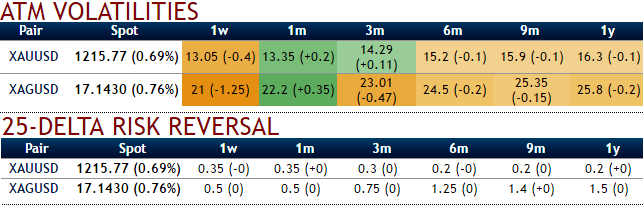

The current implied volatility of 1m ATM XAUUSD contracts are at 13% and above with positive skews signifying hedgers interests are in well balanced on either side but slightly biased towards OTM call strikes, and it is likely to spike higher for 1m tenors.

While delta risk reversals substantiate these figures with upside risk sentiments (observe positive shifts across different tenors). By this, we mean guaranteed hedge at the higher strike (worse than the outright forward rate if unleveraged) in order to benefit from a favorable market move down to the lower strike.

Hedging Strategy: Option straps (XAU/USD)

As the risk reversal numbers allow for a customized hedging solution, tailored to your risk and hedging profile contemplating both side risks. Risk Reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Hence, we recommend deploying hedging strategies to arrest upside risks with longs positions in 2 lots of ATM vega calls with 1M expiry and 1 lot of ATM vega puts of similar expiries.

Vega instruments are preferred as it takes care of the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

As shown in the diagram, the Vega of a long call option position is USD138 and IV increases or decreases by 1%, the option’s premium will increase or decrease by USD138, respectively.

Subsequently, this XAUUSD option straps strategy would take care of ongoing upswings and abrupt downswings and yields handsome returns.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data