Fundamental glimpse: For us, global economy looks seems under recessionary cycle as all asset classes have been struggling coupled with some other macroeconomic indicators, as a result gold's tumble has also been relentless.

The recent upbeat economic data in US more inexplicably synthesized with increased gambles on Dec Fed rate hike pumped a double blow to the precious metal, knocking-off the bullion to the lowest levels since 2010.

On the Comex division of the New York Mercantile Exchange, gold futures for December delivery fell 0.05% to $1,070.20 a troy ounce.

Despite last month's personal income in U.S. rose by 0.4% and consumer spending 0.1% gold futures were edging down yesterday amid stronger dollar.

For technical reasoning please refer below link:

http://www.econotimes.com/FxWirePro-Yellow-metal-forms-descending-triangle-break-out-below-base-to-confirm-bearish-continuation-121595

Hedging Frameworks:

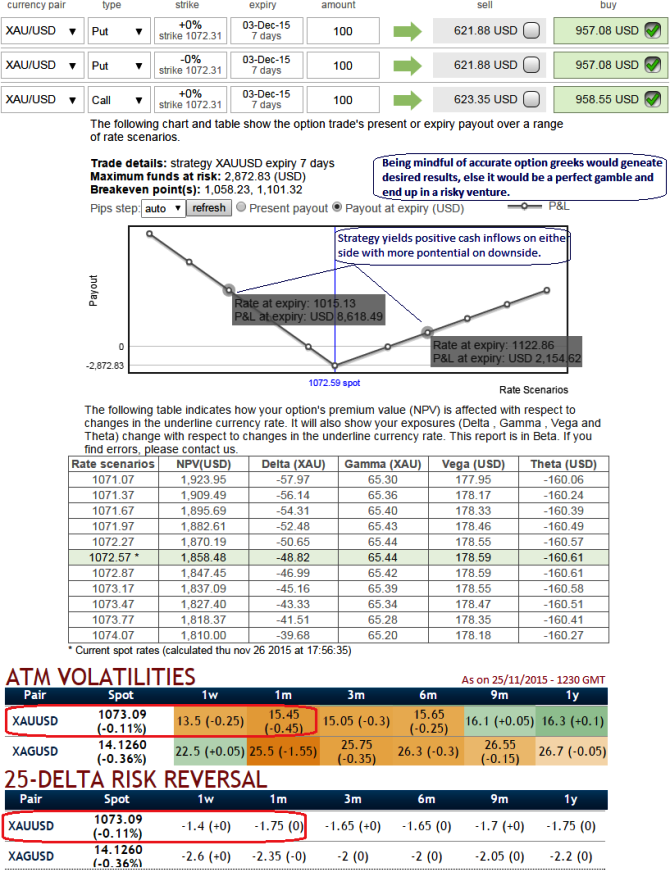

As we are bearish on the bullion market, IVs and risk reversals have been highly aggressive, we would like to be benefitted from downside momentum by implementing this strips strategy.

By buying two ATM Put Options & one ATM Call Option, of the same strike price, expiry date would hedge the both abrupt rallies and anticipated dips.

Risk reward profile:

Risk is mitigated and limited to the extent of premium paid (US$ 2872.71) to the option writers.

Reward is unlimited until the expiry of the option (Payoff functions are expressed in the diagram).

Please be noted that one can still mint money even if prediction goes wrong - but the price should spike in the adverse trend swiftly (i.e. ATM call bought that we buy has to beat the cost of buying all the options and still bring in some profits). BEP on adverse side - 1122 and above.

FxWirePro: Gold seems vulnerable in global economic cycle - Stay Hedged with Option Strips

Thursday, November 26, 2015 12:57 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound

FxWirePro: GBP/USD slides as UK political uncertainty weighs on pound  EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186

EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro: USD/CAD changes short term trend from neutral to bearish

FxWirePro: USD/CAD changes short term trend from neutral to bearish