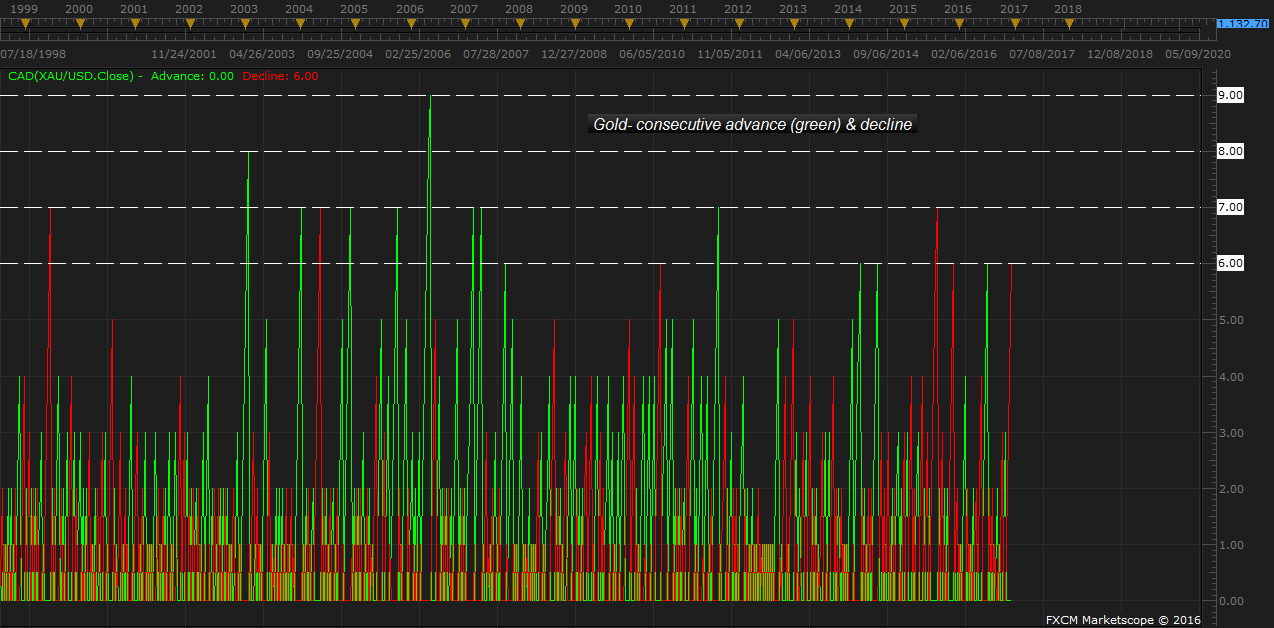

Facing a stronger dollar after Donald Trump’s election victory that led to rallies in equities, the price of the yellow metal has declined to the lowest level since January this year. The failures of risk aversion to materialize with regard to the US election coupled with a stronger US dollar have been causing havoc for the yellow metal since November. The gold price which was up around 30 percent for the year at one point is up little more than 6.5 percent YTD as of now. Gold is currently trading at $1130 per troy ounce, down from $1375 per troy ounce in July. Gold had a consecutive weekly bull run in July that lasted for six weeks.

But, since November, the gold price has declined for six consecutive weeks, the longest since November last year. While we remain fundamentally positive on gold, there are strong headwinds in the short run, which could push prices to test the $1000 level once more.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed