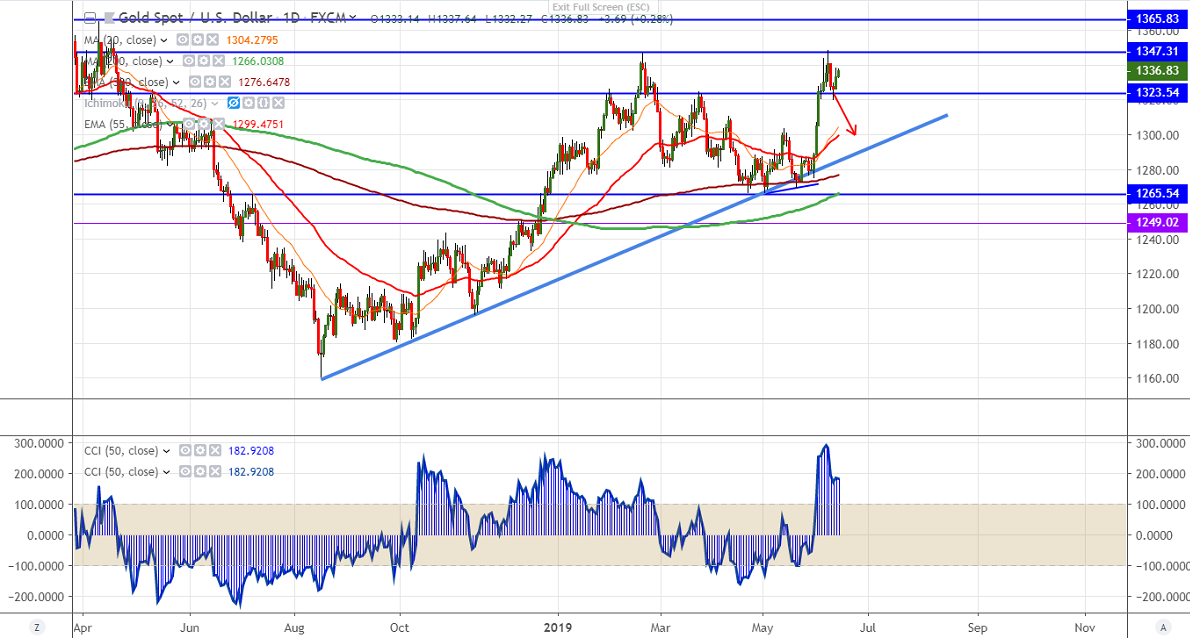

Gold has shown a minor jump of $6 after slightly weaker US CPI.Short term trend is bullish as long as support $1320 holds. The slight recovery in US dollar index is putting pressure on yellow metal. It is currently trading around $1335.

US Dollar Index -Trend weak. US Dollar index hits high of 97.02 around 40 pips from low of 96.59.Short term trend is weak as long as minor resistance 97.40 holds.Any violation above 97.40 targets 98. It is currently trading around 96.91.

US 10 year yield- Overall trend negative. It has lost more than 3% after US annual CPI came at 1.8% compared to forecast of 2.0%.It hits 2.05% on Jun 7th lowest since Sep 2017. It is currently trading around 2.113%.

S&P500: Intraday trend - Bearish.It has declined more than 50 points after hitting high of 2911 and is currently trading around 2876.90.

On the higher side, near term resistance is around $1338 and any violation above will take the yellow metal to next level till $1346/$1350.

The near term support is around $1328 (10-day MA) and any break below confirms minor weakness a dip till $1320/$1309. Any major weakness only below $1300.

It is good to buy on dips around $1330-31 with SL around $1323 for the TP of $1346/$1350.