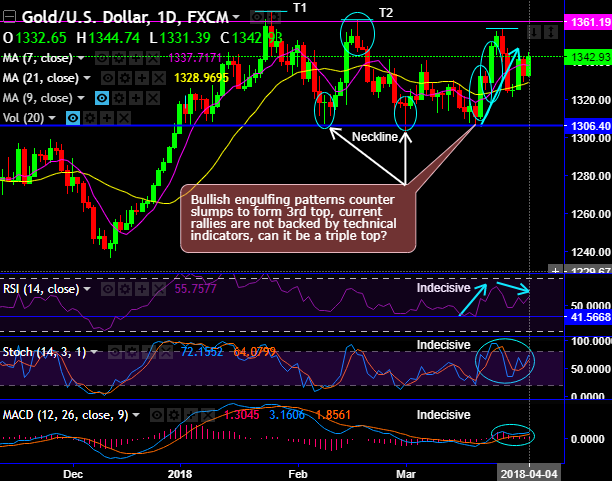

The gold (XAUUSD) on daily terms: Bullish engulfing patterns have occurred at 1332.05 and 1347.12 levels that counter the previous formation of double top and on track of forming the triple top pattern as bears resume at 1356.78 levels.

These bullish patterns have occurred after testing strong support at neckline, but this cannot be isolated as stern bulls rallies as RSI, and stochastic curves have been indecisive and MACD on the other hand also signals indecisiveness.

You could make out that the price has been oscillating between 1365 and 1306.40 levels since 3rd January.

Despite the bullish DMA crossover, the prices are stuck between 7DMA and 21DMA as RSI and stochastic doesn’t confirm bullish momentum convincingly and MACD has also been indecisive.

On a broader perspective, we must appreciate the bullish strength of this precious metal price as the intermediate trend has been spiking through rising wedge pattern, and especially after the strong test of support at around $1300 mark, on the flip side, bears resume exactly at rising wedge resistance (refer weekly plotting).

Both leading oscillators have been indecisive even in this timeframe.

While same has been the case with trend indicators, both MACD and EMAs are also indecisive to signal further uptrend.

Hence, long-term investors can wait and watch out closely for decisive breach below 1365-68 levels for a safe play with long hedges.

Accordingly, we recommend buying delta-hedged 3M XAUUSD 25-delta risk reversals @ 1.3/1.6 vol in order to arrest bullish risks.

Please glance through the option pricing of OTM call and OTM put that seem to be exorbitantly priced-in. 1w (0.5%) OTM calls are trading at 85% more than NPV, whereas the IVs of these tenors are trending just shy above 10.7%. Hence, one can easily spot out the disparity between IVs and option pricing.

Well, on speculative basis, writing expensive calls and puts are recommended to establish short strangle strategy that are the best suitable amid prevailing lower IV condition of XAUUSD, hence, the strategy reads this way, shorting 1W (1%) OTM puts as well as 1W (1%) OTM calls for a net credit.

The strategy not only gives you the advantage of an anticipated volatility crush but also give us some room to be wrong because we may short premium narrowing strikes while in greed of collecting more credit than when IV is low.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty