As the US president, Trump escalates trade war in Q3, in the latest twitter tirades and his latest appearances in front of his supporters the US President has indicated something akin to a “strategy” behind his trade war policy. He is for example pleased about the weak Chinese stock market, as if that was a positive signal for the US economy. What is even worse: by giving tariff revenues a central role in fiscal policy the US President illustrates that his “tough approach” does not aim at enforcing a half-way amicable agreement. The trade war will remain in place regardless of how much the Chinese cave in. It is a means to a completely different end: of whipping in his followers. That makes the question of the consequences for USD exchange rates even more relevant.

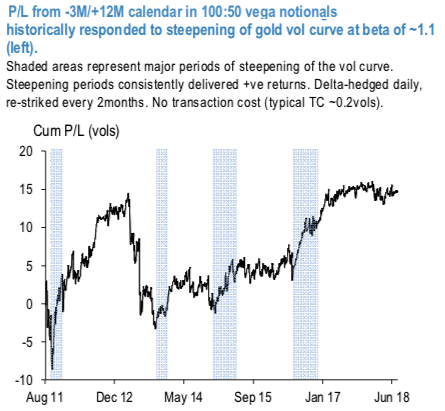

Amid this macro-level development, historical performance of XAUUSD vol calendars (the above chart) shows a consistently good track record during vol curve steepening episodes, with 1.1 beta of returns to vol pts of steepening. 12M-3M should widen by about 1.1vols in order to mean-revert to its 1Y average (from the currently 2 sigma too narrow gap); a rough assessment of the mean- reversion speed of the vol spread places its half-life at around 2.5 weeks which, being well below the maturity of the short leg of the spread, should give enough time for the term-structure dislocation to correct.

Moreover, at current market the structure is showing 2vols of vol carry from the short front-end straddle. Accounting for both P/L components (vol curve and implied-realized gap) in a multivariate historical regression we estimate >1.6vols of potential gain, while 1Y @10.7vols and at a historical low should limit the downside. With the latest positive turn in trade developments, one potential near term risk to the short front vol leg that still remains was the recent GDP print.

Still, given the tight risk-reversals, implying a spot/vol correlation near zero (at 7%), large moves in the spot should not overly impact the front-end of the curve and trigger a further tightening of the 1Y-1M spread.

To summarize, with the current gold surface dislocation mostly concerning the elevated front end vols and a sizeable implied-realized gap we overweight the short vol front leg:

Sell 3M @9.45 choice vs buy 1Y @10.3/10.65 indic XAUUSD straddles in 100:50 vega notionals, keep delta-hedged. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 93 levels (which is bullish), while articulating (at 14:38 GMT). For more details on the index, please refer below weblink:

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data