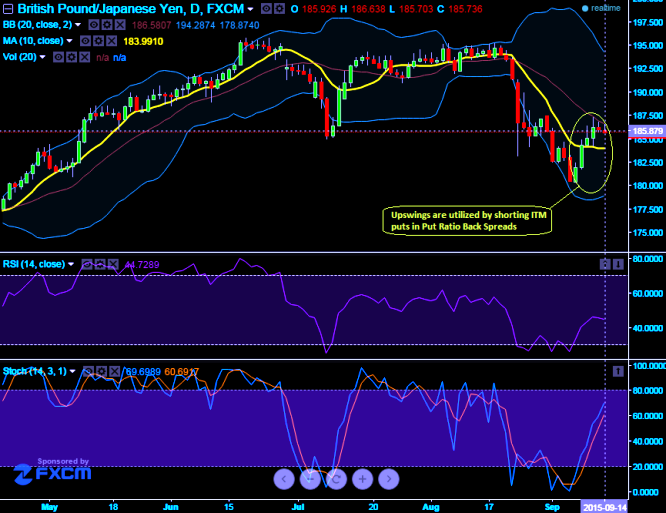

On monthly chart, the formation of hanging man pattern candle on peaks of uptrend at around 193.456 levels. This hanging man followed by two long real body red candles would reveal a medium term downtrend direction. Overall pattern on the pair fixes it bearish view for a target of 177.125 to 175 levels. In addition to that huge volumes are popping up to show bearish sentiments, while leading oscillators (RSI & slow stochastic) show convergence with dipping prices at current levels. RSI is currently trending at 55.9802 levels, while %D crossover above 80 levels signifies the selling momentum is intensifying.

With this technical reasoning, we recommend arresting further downside risks of this pair by hedging through Put Ratio back Spread.

Short term ITM shorts are exactly suitable for short term upswings that have begun from last 4-5 days, expect the underlying currencies GBPJPY in this case to make a large move on the downside. So, purchase 2 lots of At-The-Money -0.50 delta puts and sell one lot of (1%) In-The-Money put option, use expiries suitable to the individual circumstances.

How does it favor hedging objective: The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit. The delta of combined positions should be around -0.38 with negative theta value. If a disciplined hedger strictly follows all these mathematical computations, then irrespective of market sentiments, one can be rest assured with the riskfree exposures in his foreign trade.

FxWirePro: Hanging man signals potential downswings of GBP/JPY, put backspreads well placed to hedge

Monday, September 14, 2015 7:17 AM UTC

Editor's Picks

- Market Data

Most Popular