GBPJPY has had a roller coaster ride on Brexit drama. The pair has shown steep slumps again below 140 levels after considerable consolidation phase (refer 2nd chart). For now, it seems to be all quiet in London, however, off-the screen it is all systems go. Nigel Farage achieved more than 30% of the votes in the EU elections with his Brexit party that was only established a few weeks ago.

As a result, he will probably chase the possible candidates for May’s succession – 11 at the moment – arguing that his party received the highest number of votes, regardless of the fact that the votes of the pro-EU voters were distributed over various parties. The candidates who are ready to take on the position of Prime Minister (amongst the familiar faces such as Boris Johnson, Dominic Raab, Michael Gove) all favor Brexit, many of them would even accept to leave the EU without a deal if that was unavoidable.

In the current power struggle, it could, therefore, become clear that May, despite what seemed like indeterminable stubbornness when sticking to her red lines, giving in to the EU and Parliament very late, probably too late, might have been the lesser evil as regards the Brexit process. As usually happens when changes occur, it is usually clear what we stand to lose but not what we will gain.

However, this fresh start has very little allure. There is a high risk that May’s successor will choose a much tougher stance towards the EU so as to unite the Brexiteers behind him and might well be willing to accept a hard Brexit.

As a result, the uncertainty for companies in connection with Brexit has risen significantly again which might have real economic consequences as a result of reduced investment activity. The collateral damage of the power struggle in Westminster could hit Sterling hard, and as a result, we remain cautious.

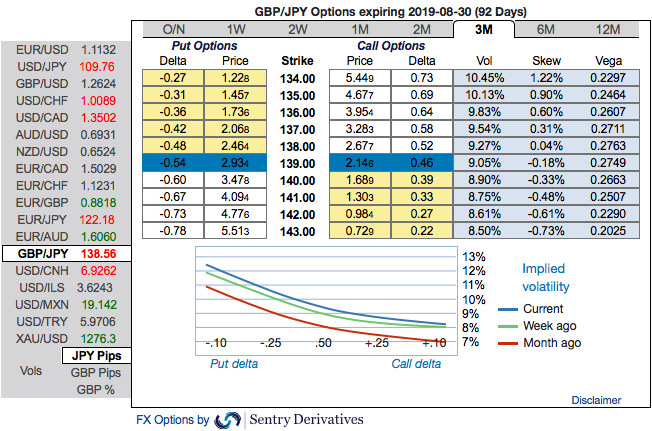

OTC outlook and Hedging Strategy: Amid huge turbulence, please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 134 levels (refer above nutshell evidencing IV skews, 1st chart).

Accordingly, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 138.56 levels).

The rationale for PRBS: Well, the traders tend to perceive these trades as a bear strategy, because it deploys more puts. But actually, it is a volatility strategy.

Hence, entering the position when implied volatility is high and anticipating for the inevitable adjustment is a wise thing, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a “price neutral” approach to options and one that makes a lot of sense.

Every underlying move towards the ITM territory increases the Delta which inturn boosts premium. As you could observe spot GBPJPY keeps dipping, these delta longs would become in the money, while these derivatives instruments target further bearishness of this pair. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -8 (which is absolutely neutral), while hourly JPY spot index was at 61 (bullish) while articulating (at 07:59 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One