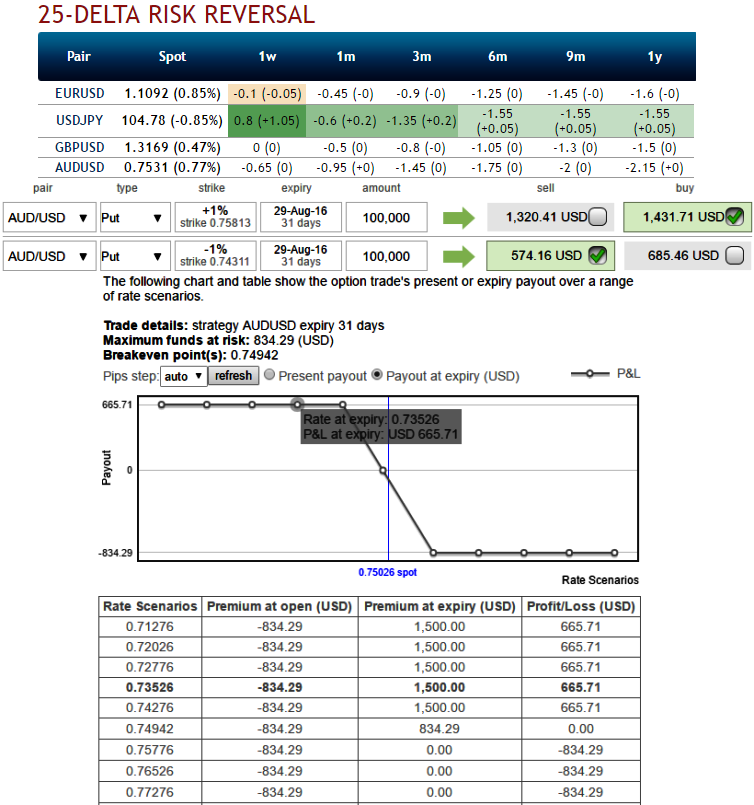

AUDUSD delta risk reversals indicate bearish-neutral sentiments in FX OTC markets as there is no hedging interest seen in near terms (see for 1W expiries) but this has again shown in favour of bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for downside risks in both short and long term.

You can observe the reducing IVs of ATM contracts are collapsing below 12.5%, shrunk away after recent Fed policies maintained status quo, but it is likely to perceive at an average of 10.5% in the long run that would divulge hedging traction (see 3M-1Y ATM IVs).

Since risk reversal is in bearish-neutral, any abrupt upswings could be capitalized to build in shorts with shorter expiries and delta long instruments for hedging downside risks have been favoured by acknowledging the stabilized implied volatility in 3M tenors.

Hedging Strategy of AUDUSD:

As we reckon that the risks around the AUD would factor into the monetary policy decision by the RBA which is scheduled on Tuesday 2nd August. A 25bp rate cut to a new record low of 1.5% is pretty much on the cards.

Hence, go long in 1M (1%) ITM -0.86 delta put option while shorting 2W (1%) Out of the money put with positive theta or closer to zero for time decay advantage on shorter tenors on the short side.

Please observe the payoff table, as AUDUSD drifts below spot ref: 0.7495 the strategy constructed above is likely to fetch positive cash flow on expiry, but use tenors as accurately as stated above (the expiries used in the diagram are for demonstration purpose only).

Alternatively, since the potential in Bull Run on the verge of a surge in the dollar. This strategy can also be executed by buying 1M protective At-The-Money 0.5 delta put option while writing 2W out-of-the-money covered calls with positive theta value.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?