Key Economic Fundamentals:

JPY losses have been compounded by renewed warnings from Japan’s Finance Minister that it could intervene to stabilize the JPY if necessary (in spite of the US Treasury placing Japan on its FX watch list).

But the major focus for the day is Japanese trade balance and current account balance prints.

Japan recorded a 754.9 JPY billion surplus in March of 2016, widening from a 223.47 JPY billion surplus a year earlier but missing market consensus of 834.6 JPY billion surplus.

Japan recorded a current account surplus of 2,434.90 JPY billion in February of 2016, up significantly from 520.8 JPY billion in a month earlier and beating market, projections. It was the 20th straight month of surplus and the largest since March 2015.

Japanese policymakers seem to want a weaker JPY; their discomfort is about the JPY's level, not the size or speed of the move

Engineering a weaker JPY has become more difficult as policymakers now have to battle a sceptical FX market as well as international political pressure.

On the flip side, Canadian public and private sector investment intentions on non-residential capital construction & machinery is expected to fall 4.4% y/y in 2016, suggesting a second consecutive annual decrease in spending.

The decline was driven by a fall in private-sector which is anticipating to lower investment spending by 9.3% from the previous year, while government spending on investment is expected to rise by 4.4%.

Hedging Framework:

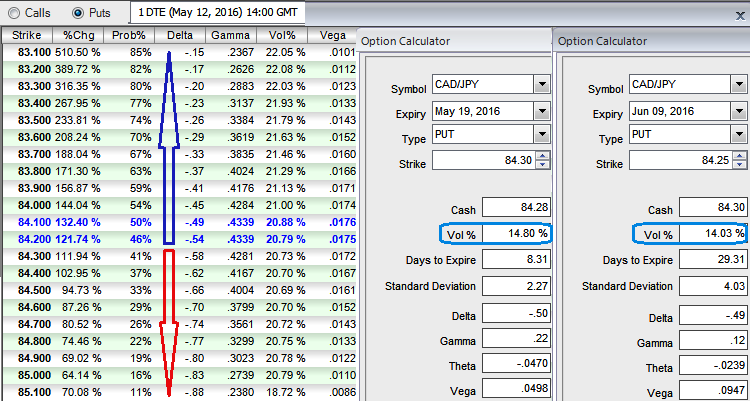

The implied volatility of 1W CADJPY ATM contracts 14.80% and likely to reduce to 14.03% for 1M tenor. While, OTM put strikes have healthy probabilistic and vega numbers with rising IVs. This would imply that the put contracts of these strikes are most likely to finish in the money on expiration.

So, shorting expensive OTM or ATM calls during such bearish situations with shorter expiries would likely result in positive cash flow on expiration as ATM IVs are likely to fade away in short run.

As a result, we capitalize on such beneficial instruments and deploy in the below strategy.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

Go long in CADJPY 1M at the money delta put, Go long 1M at the money delta call and simultaneously, Short 1M (1%) out of the money call with positive theta.

If one is bearish to very bearish, then one can even eye on writing ATM or ITM calls as well as an alternative to shorting the underlying spot FX.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed