New Zealand posted a NZD 1265 million trade deficit in August of 2016, compared to a NZD 1090 million shortfall a year earlier and missing market expectations of NZD 766 million gap.

Exports dropped by 8.7 pct, led by lower sales of milk powder, butter, and cheese. Imports fell by 3.1 pct, driven by a cut in the purchase of capital goods.

Technically, the long-term trend has been bearish, more downside traction is foreseen in the months to come as the current prices on monthly charts are well below 7&21EMAs with leading oscillators to signal selling momentum.

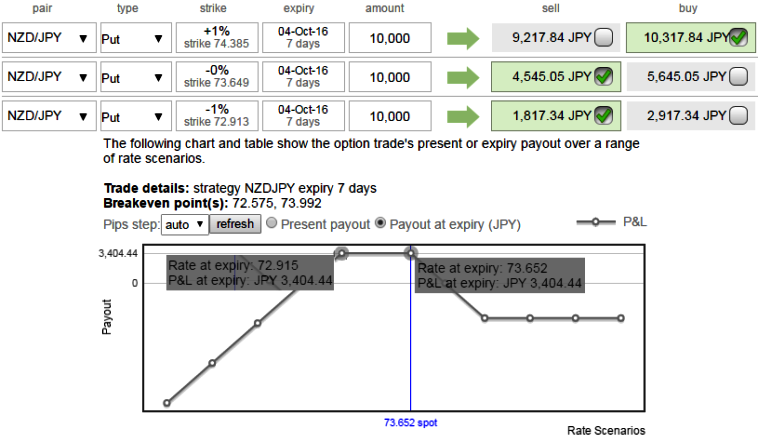

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: Unlimited downside and limited upside profit potential and higher IVs favor option holders. Fundamentally, RBNZ is likely to ease in its monetary policy with 25 bps to keep OCR at 1.75% in November.

1W ATM IVs are trending higher with decent numbers at 12% which means the market thinks the price has potential for large movement in either direction, but you can observe the %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts).

How to execute: Go long in 1m (1%) ITM put option and simultaneously add shorts on 1w ATM put option and one more (1%) OTM put option of similar expiry.

Maximum returns are limited to the extent of initial credit received if the NZDJPY rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of NZDJPY makes vivid downswings below the lower BEP.

Please be noted that the tenors chosen in the strategy are just for demonstration purpose, use right expiries as stated above.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed