According to reports, Finance Minister Gordhan would receive a ‘warning statement’ which indicates that he is about to be charged with an offence. This is most likely a politically motivated charge and consequently, we think political instability can increase substantially in South Africa. That’s bad news for ZAR and indeed for most ZAR denominated assets.

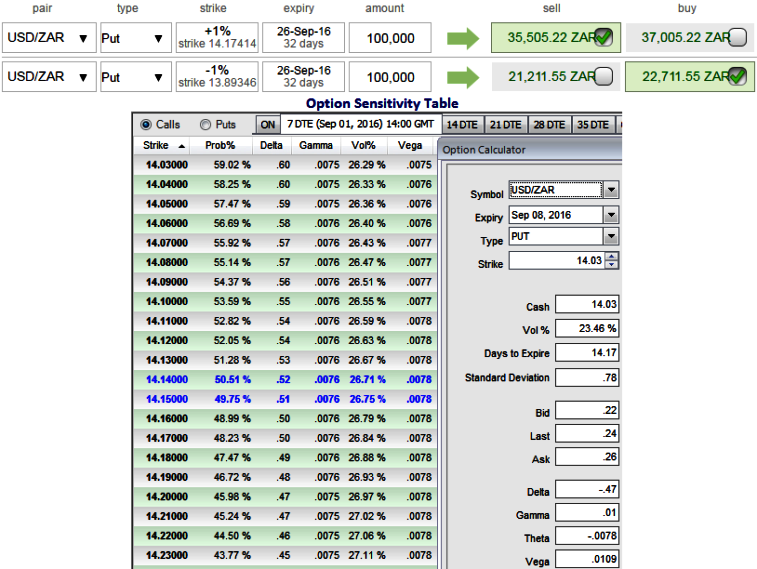

Stay Short in USDZAR: Current spot ref. at 14.0710, contemplating above political turbulence we recommend USDZAR shorts but with positional trades using diagonal credit put spreads (DCPS), targeting 8.5% move lower to 12.8749 in medium terms. We place a stop-loss 1% higher than current levels at 14.1741 9 (as shown in the diagram, one can also keep the tolerance levels of 1-2% extra).

Our trade horizon is 2 months. The position generates positive carry of about +60bp / month. Please be noted that the tenors shown in the diagram are just for demonstration purpose only, use narrowed tenors on the short side (preferably 2w or so would give you ideal entry point in the strategy). These diagonal option positions are likely to arrest both short-term upswings and long term downswings.

Risk Profiling: China, commodity prices, and FOMC constitute major risks Prominent risks to this recommendation include the resurgence of negative headlines from China, a collapse in hard commodity prices, and episodic fears regarding imminent FOMC rate hikes, or hikes occurring at a faster pace than anticipated.

Additionally, there may be domestic risks stemming from political infighting, labor unrest, and ratings downgrades. Bouts of profit-taking and consolidation may also undermine the position, while a lack of liquidity may additionally be a consideration for the trade, exacerbating moves in either direction.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed