NZDUSD has been neutral inside a 0.6860-0.6980 range.

On medium term perspective: Lower to at least 0.6800. The US dollar has had an impressive rise since the US election and has a potential to rise further during the months ahead. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

The NZ economy is strong and Global dairy prices in New Zealand posted their sharpest decline in over 10 months at the latest Global Dairy Trade (GDT) price auction held Today. Also, it remained weaker than what markets consensus.

Largely, prices in GDT auction dropped 3.9 pct, following a 0.5 pct decline in the final auction of 2016. There was also a sharp 7.7 pct dip in whole milk powder prices in the latest auction to USD3,294 per tonne, but these forces are submissive to the US dollar’s trend.

On the flip side, the FOMC delivered the target range for the federal funds rate by 25bp to 50-75bp at its December meeting as anticipated.

The FOMC’s target range for Fed Funds interest rates by 25bp to 0.50%-0.75% seems justifiable and hinted for more hikes on cards in 2017, in the end, it is imperative that the Fed also believes rising inflation and raises interest rates more quickly than it has done so far.

As only that justifies a strong US dollar. Some market participants are likely to expect tonight’s FOMC minutes to provide an insight into the US central bankers’ point of view as regards this. And in this context, the following applies: the larger the number of FOMC members who also see upside risks for the inflation outlook due to the potential economic policies of the future US President, the better for US dollar.

Well, greater clarity around the New Zealand policy backdrop – more easing and tougher macro-prudential arrangements which should bias the neutral rate lower in New Zealand over time – will open up genuine downside for NZD moving into 2017. The forecasts are at 0.68 by Q1’17 and at 0.66 by Q2’17.

OTC outlook and hedging framework:

As a result of the speculation in the FX market, although the Kiwi dollar surged a bit today but sensing more bearish pressures in the weeks to come especially after data showed that China’s imports dropped far more than expected last month and as the greenback remained supported by Hawkish US central bank’s tone.

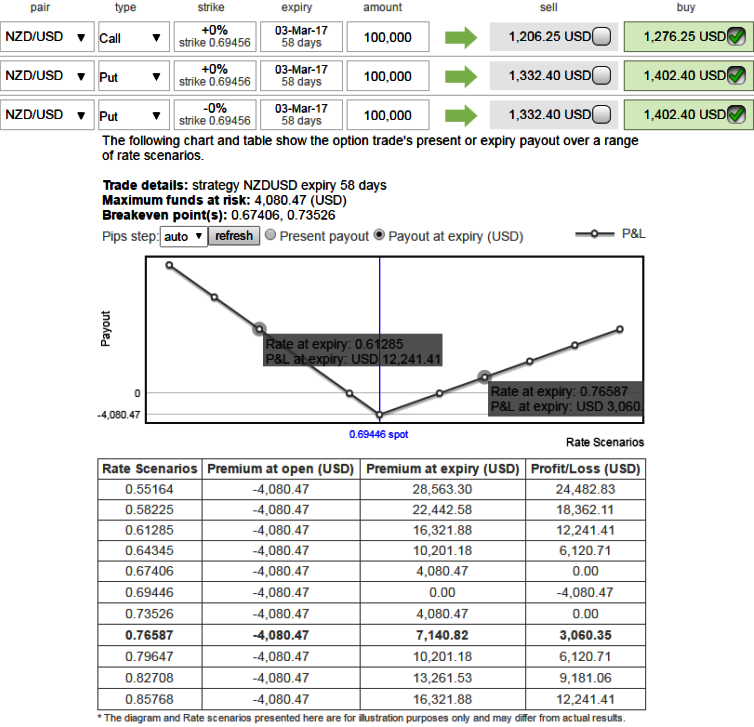

Well, to mitigate the further bearish risks, at spot reference 0.6948 we reckon the NZDUSD options strips with narrowed strikes.

Hence, we advocate to initiate longs in 2 lots of 2m -0.49 delta put options, while buying 1 lot of +0.51 delta calls of 2w expiry.

Even if the underlying spot goes against our anticipation, the underlying risk is properly mitigated regardless of swings. As you can probably understand from the payoff function, the strategy can also be utilized on speculating grounds as it is likely to fetch certain yields.

Please be noted that the strikes and tenors chosen in the diagram are just for the demonstration purpose only, use the key inputs of the strategy as per your requirements and exposure.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data