Gold spot is struggling to break and sustain above the resistance at 1275 levels again despite CFDs have been drifting up with a safe haven sentiments, or on the Comex division of the NYME, gold futures contracts for June delivery were up 0.35% at $1,275.80.

Yellow metal is highly receptive to shifts in U.S. rates, as a rise would lift the opportunity cost of holding non-yielding assets such as bullion.

A steady lane to higher rates is perceived as less of a threat to gold prices than a rapid series of increases.

Hedging Mechanism & OTC Observation:

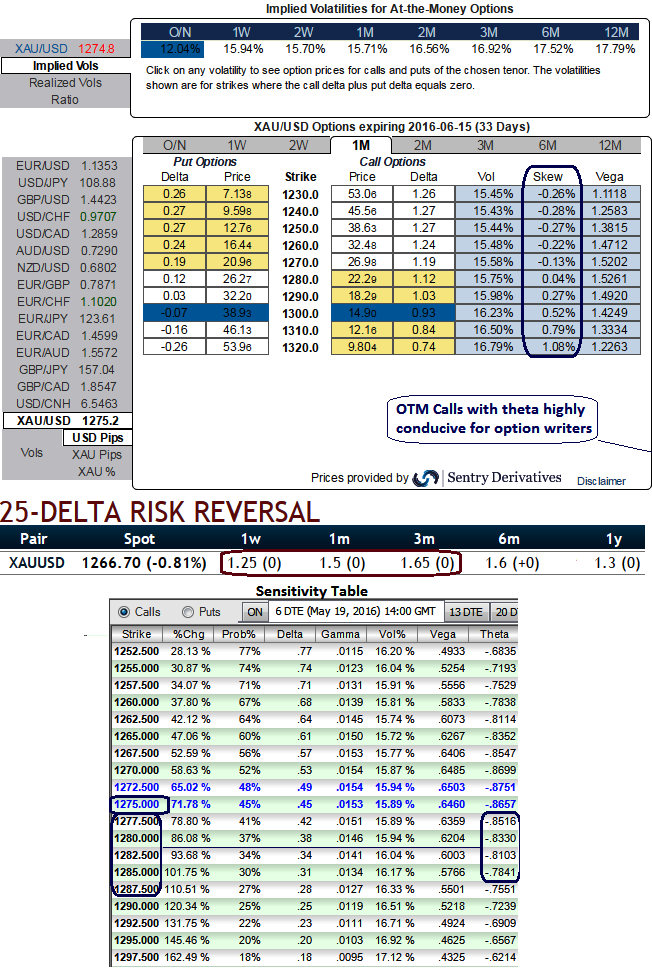

The implied volatility of 1W XAU/USD ATM contracts 15.94% and 15.71% for 1M tenors, cheers..! Good news for writers.

The skew appears negligible compared to the volatility, strongly suggesting spread with OTM strikes-like structures, conducive for writers.

Please be informed that the highest theta numbers on OTM call strikes, thereby, the writer of option most unlikely to be obligated for option exercise.

For ITM and OTM options as time to expiry draws nearer, Theta lowers and decreases. The above sensitivity table is an instance as to how Theta responds when the option is ITM, ATM, and OTM, and as time passes. You can also observe the dramatic impact of time decay (Theta) for an ATM option approaching expiry.

How to execute:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Eying on favourable theta shifts considering lower skew and shorting expensive calls with shorter expiries. As a result, we capitalize on beneficial instruments to reduce hedging cost.

How to execute:

Go long in XAU/USD 2M at the money -0.49 delta put, go long 4M at the money +0.51 delta call and simultaneously, short 1M (1%) out of the money call with positive theta.

The dollar's recent rapid slide has been accompanied by a constant backdrop of dovish cooing from the Fed. Until this week, both equity and commodity markets had embraced the weak dollar as the elixir to solve all their ills.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different