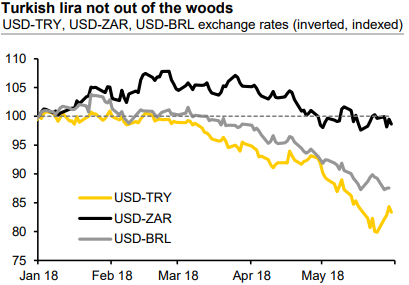

The Turkish lira is still being buffeted around from day to day by news in both directions. The currency had a good rebound so far this week following re-assurances by the economic policy management team in London that the central bank stands ready to hike rates again on 7 June.

Market conditions turned somewhat more helpful too as the sell-off of Italian bonds paused. But the rebound was modest after all (refer chart) and relief did not last long: yesterday, the US dollar began to strengthen again. And from the local side, Turkish trade data reminded markets about the perils of a rising oil price: trade data for April showed noticeable widening of the deficit; exports were down 2%m/m (seasonally adjusted), imports were up 2%, which contributed to the widening.

Finally, the latest Metropoll survey highlighted a 3pp month-on-month slippage in President Erdogan's approval rating (to 46%) from the previous month – this very likely reflects opinions about his handling of the lira crisis this month.

On the one hand, the market prefers to see Erdogan's influence and interference with economic policies eliminated after the elections; but equally, it frets about broader stability should a fractious opposition coalition with no recent governing experience ascend to power. How policy will look under this scenario is a question mark. To put it bluntly – the lira is not out of the woods. If CBT were to skip a rate hike on 7 June simply because temporary calm happens to prevail at the time, that would be confirmation that, despite the assurances, the central bank's 'behind the curve' style has not changed.

Overall, the tendency for inflation would be to peak and moderate – but only slightly, say to around 9% in the coming months. This extent of moderation will not neutralize Turkey’s long-term inflation, though – at the best, it can bring near-term relief. In the medium-term term, for the stabilized lira, we, therefore, expect USDTRY to head up towards the 5.00 mark.

Trading tips:

Short 2m ATM calls, Sell 1Yx1Y USDTRY FVA vs buy 1Y ITM call.

Buy 2m USDTRY call (4.50) and EURTRY call (4.83) (equal weighted USD notional).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics