The dollar is trading about 5% higher, in real terms, than its average level of the last 20 years, and some 23% above the 2011 low. With the global economy Surfing the global expansion, and growth becoming more balanced and more synchronized, the dollar looks expensive. It rallied on the back of the Fed’s lead in the monetary policy cycle. Not only is the rest of the world slowly catching up, but it seems increasingly clear that the Fed will remain extraordinarily cautious in its policy moves.

Fed Funds is projected to target about peak at 2.00-2.25%, which is consistent with real 10y yields peaking not far from current levels (52bp) and well below the 72bp we saw in December 2016. That’s not negative for the dollar but means that the currency is vulnerable both to its high valuation and to improving FX fundamentals of other major currencies, including but not limited to the euro.

Judging from the number of client queries on the topic this past week, macro investors are increasingly devoting mindset and possibly option premium to hedges against an unpleasant retracement higher in the dollar from oversold levels.

Spot out wide divergence between the USD index and rate differentials, the surge in 10Y Treasury yields above 2.60, technically oversold price levels and momentum divergence set-ups in some USD-pairs, and the likelihood of profit taking on crowded Euro longs into next week’s ECB in anticipation of jawboning against recent currency strength are the commonly cited factors to support a tactical de-risking of short USD reflation trades.

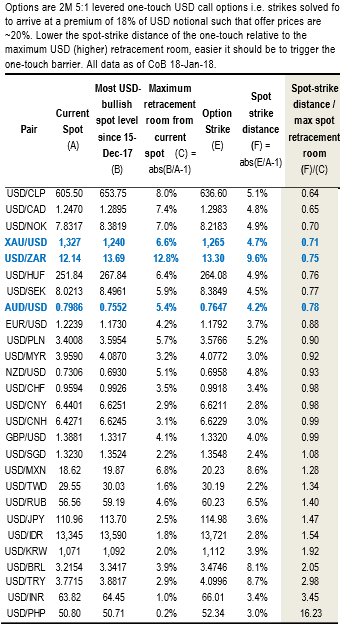

On this ground, the above nutshell displays a simple relative value screen for short-dated one-touch (OT) USD call options that provide highly leveraged exposure to a broad USD rebound. The rich/cheap measure for directional (not delta-hedged) options used in the table is the ratio of spot-strike distance of 2M 5X geared (i.e. 20% price) OTs deflated by the maximum retracement headroom for the dollar since the start of the downtrend in mid-December; smaller the ratio, less the heavy lifting required of spot in order to trigger the maximum option payout. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -77 levels (which is bearish). While hourly USD spot index was inching towards 26 (bullish) while articulating (at 09:34 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025