Market participants entering the FX OTC derivative market are confronted with the fact that the volatility smile is usually not directly observable in the market. The degree of moneyness of an option can be represented by the strike or any linear or non-linear transformation of the strike (forward-moneyness, log-moneyness, delta). The implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile.

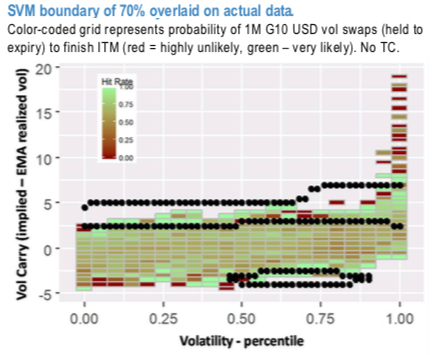

A framework based on machine learning techniques has been utilized in long/short FX vol trade discovery process. It exploits two cornerstones of gamma trading: implied volatility pricing (which accounts for vol mean reversion propensity) and implied-realized volatility spread (a proxy for the expected carry) in order to discover which implied vol and vol carry combinations lead to favourable vol buying/selling opportunities.

1M volatility selling P/L hit rate is represented as color-coded cells in the Percentiles (implied vol) - Vol carry grid in 1stchart with the dotted black line demarking the machine learning model implied regions of favourable vol selling (the island on the bottom and the stripe across). SVM (support vector machine), a supervised machine learning model, was used to model the 1stchart non-linear decision boundary.

With individual G10 currency SVM models in hand we rank USD/G10 vols based on estimate of success in vol shorting (refer 2ndchart).

The latest leg of Italian political risk re-emergence brought back investors’ interest in hedging the exposure. With USDCHF stuck in a slow gear one could viably consider tactically owning EURUSD vols financed by selling delta hedged OTM USDCHF calls amid elevated risk reversals (near zero cost) and the convexity profile that provides some protection in event of a CHF spike.

Alternatively, one could take advantage of the RV and construct a conditional EUR directional hedge: buy 2M EURUSD ATM puts vs. sell USDCHF ATM calls @20bp USD (@1.1/1.3 vols, spot ref EURUSD @1.1456 and USDCHF @0.9945), not delta-hedged. Our analysts expect modest CHF appreciation under low global vol conditions and a possible sharp rally in the event of intensification of political temperature in Italy. Both scenarios should leave short USDCHF call OTM. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -86 levels (which is bearish), while hourly USD spot index was at 35 (bullish) while articulating (at 10:35 GMT). For more details on the index, please refer below weblink:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025