We open a short position in AUD this week, in part because it offers exposure to a more extended period of soul searching around China (these policy-induced mini cycles tend to be reasonably durable and exploitable), in part because we believe that the risks of a resumption of the RBA’s easing cycle are not adequately priced.

Our preference is for EURAUD rather than AUDUSD as the removal of French political risk clears the way for real money investors to re-weight their portfolios back to European assets in keeping with the outperformance of the region.

EURAUD also serves to partly hedge the handful of short EUR cross positions we hold where a hoped-for improvement in local currency factors is either absent (SEK) or inadequate to compensate for the broad-based rehabilitation of EUR sentiment (CHF and CZK).

We’re adding EURAUD to boost our overall EUR exposure as the passage of the French election this weekend should clear the way for an intensification of portfolio inflows into the region in keeping with the cyclical acceleration in the region’s economy (the Italian election is too distant a prospect to command a risk premium).

AUD, by contrast, is likely to be weighed down, firstly by its stand-out sensitivity to China sentiment (underlying economic linkages and Australia’s status as a liquid proxy for China), and secondly by the downside risks to RBA policy in 2H17, including from a housing market that’s not liking its macro-prudential medicine. There’s the risk of a tactical bounce in AUD from next week’s Federal budget (more infrastructure spending?), but this should be short-lived.

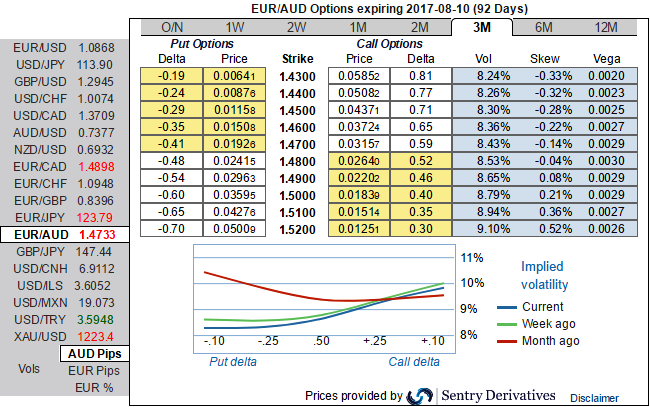

Let’s glance on sensitivity tool for 3m IV skews would signify the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

While AUDUSD still signals highest bearish sentiments among G10 currency space in next 3 month’s timeframe.

So, you would cross the threshold into a risk reversal if you want to hedge your underlying risk while lowering the cost of the premiums. Here OTC FX market indicates, this APAC currency pair seems more sensitive towards downside risks, as a result, puts looks to be overpriced.

Hence, the market pricing well reflects this view that the RBA will ‘eventually’ ease below 1.5%.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data