EURAUD looks like this currency cross has set up a new stage for its bull run as the strong bull candles with all leading oscillators are positively converging and lagging indicator to justify this in medium term but it is approaching trend line back again to seek strong support.

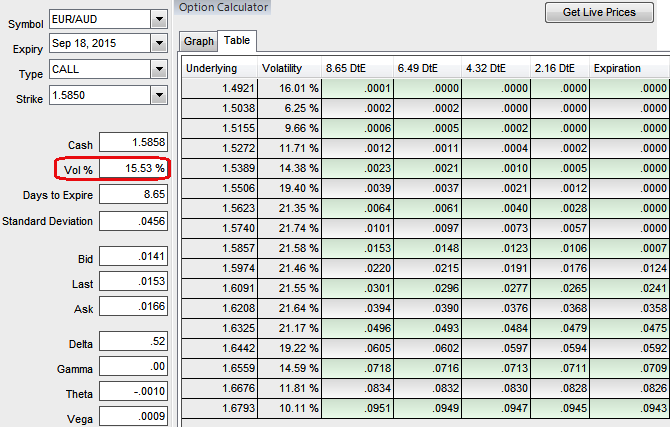

Execution: EURAUD is currently trading at 1.5857. Short two lots of 7D deep OTM strike puts. Buy one OTM strike put of the next month expiry.

Ratio spread explained in brief: This is an income strategy. You are looking for a net credit if the pair stays within a range or rises. Current IV of ATM contracts of this pair is that 12.49%. The combined Vega of the two short puts will generally be greater than that of the single long put. However, the extent to which the options are in-the-money or out-of-the-money, the time to expiration and level of interest rates are all factors that influence options' sensitivity to changes in market volatility, so the investor would be well-advised to test out any strategy using a theoretical model before actually executing a trade.

Advantage: This position will be profitable if the EURAUD stays within a range. 2 short sides go worthless due to time decay and best suitable during high implied volatility times, the passage of time, all other things remain equal, it will generally have a positive impact on this strategy.

Risk/Reward Profile: There is unlimited risk in this position, with capped reward. Early assignment, while possible at any time, generally occurs only when a put goes deep in-the-money. The maximum loss would occur should the pair become worthless.

The uptrend that has been gradually prolonging from last three months has taken one step ahead to break trendline resistance; the pair has now taken a trendline support exactly at 1.5598 which we had earlier anticipated.

FxWirePro: Higher IV increases chances of EUR/AUD vega put ratio spreads

Thursday, September 10, 2015 9:59 AM UTC

Editor's Picks

- Market Data

Most Popular