The shorts on option spreads should always be supported by theta. Theta is always friend to the option writer as the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Well, for demonstration purpose we've chosen AUD/USD "Credit Call Spread" that we had advocated this option strategy exactly a week ago:

For more readings as to why and how was it executed, please follow below link:

The strategy reads this way,

At spot rate reference on 23rd May 0.7220, long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options),

If you glance the strategy using above web link, then you would have been convinced with the certain yields that fetched you from ITM shorts.

So far short side of this strategy is performing well enough, these positions would have fetched certain yields as the underlying spot rates on expiry (i.e. 30/05/2016) are flashing at 0.7148 levels, which means premiums received from short side can be comfortably pocketed in.

As long as all other parameters remain the same.

For a buy (long) option position, Theta is negative and for a sell (short) option position, Theta is positive; time decay is bad for a buyer, good for a seller.

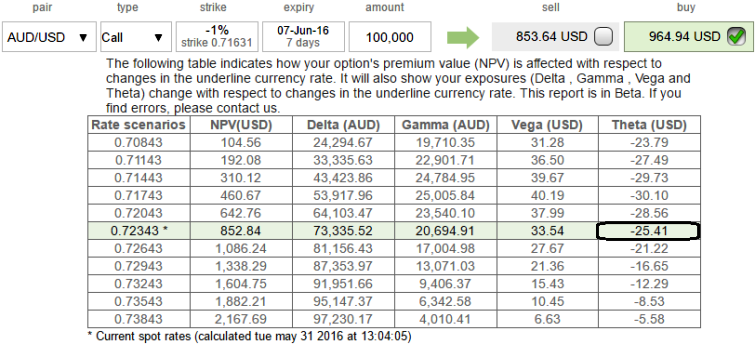

In the AUDUSD platform’s sensitivity table, Theta is given as an amount in the traded pair’s secondary currency, for an instance, 1W ATM theta here is 25.41 which means on every 1 day completion option value is likely to wipe off by USD25.41.

Theta is not a constant, it changes as the underlying market moves and time passes.

The Theta of ATM options is higher and as time draws nearer to expiry, it increases. If you are holding an ATM option and expiry is approaching, you might be better off closing out of your position.

Option sellers can reap the benefits of a high Theta near expiry by selling short dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as time to expiry draws nearer, Theta lowers and decreases, likewise the premiums on AUDUSD 1% ITM strikes would have been wiped off along with time decay.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data