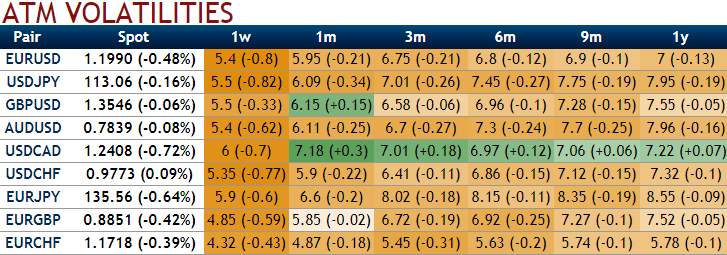

The global picture on the volatility front hasn’t really changed in recent months. Implied and realized volatility is still hovering in their low or very low percentiles.

Long carry through the 2018 year ahead outlook highlighted that elevated carry/vol ratios near multi-year highs represented the single most noteworthy thematic dislocation in FX options.

This is a result of rising interest rates intersecting with über-depressed financial market volatility and enables earning the leveraged carry in an upbeat global growth environment with low option premium spend and defined maximum loss.

We reiterate options with a higher IVs cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

The pro-risk sleeve of our options portfolio is accordingly composed of ATMF vs ATMS call spreads in two EM currency pairs, EURCNH and EURRUB; the former because of its loose correlation to the CNY TWI that is expected to remain stable in coming months, and the latter as a play on oil price strength with additional macro support from a positive current account.

Both pairs were chosen to avoid outright exposure to the broad dollar, which was consistent with our anticipation of moderate USD strength in 1Q’18 at the time of writing, and is also the historically more profitable approach to carry trading – the 1st chart demonstrates that a selection of the best four carry/vol currency pairs bought in ATMF/ATMS option spread format and held-to-expiry fared considerably better for the non-USD currencies than in USD pairs over the past decade.

Stability in EURCNH and EURRUB spot last month fully justifies their selection as pure carry candidates, though in hindsight, swifter delta gains would have resulted from simply owning USD puts. At the current market, the best value within the option-based carry universe resides in TWDINR, EURTRY, and EURCNH (refer above chart).

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand