The Federal Reserve offered up a clearly hawkish monetary policy - confounding market's skepticism and staging the Dollar

Risk trends are perhaps at greatest risk of volatility moving forward post-Fed QE plans, but it may take time to register.

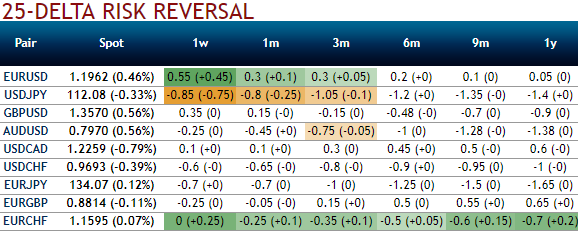

For an instance, the USDJPY 1m risk reversals scale is still near to a 3m high of -0.85 (currently at -0.80), suggesting falling demand for downside bets, i.e. put options.

25-delta risk reversals show the difference in volatility between puts and calls. A positive number indicates upside protection on the underlying forex spot [calls] is relatively more expensive. A negative number indicates puts are more expensive than calls.

The improvement in the risk reversals adds credence to the solid rally in the USDJPY spot and the Treasury yields.

Long gamma, flat/selectively short vega is the appropriate ex-ante vol portfolio orientation if we are correct on flow dynamics.

The other noticeable development on option surfaces as a result of Q3’s dollar bear trend has been the sharp compression of risk-reversals (refer 1st chart) as realized spot-vol correlations ran counter to their usual positive directionality. It will be a stretch to claim that a V-shaped rebound is in the pipeline if the dollar pauses, since USD riskies did not deliver even during the dollar bull run of 2014-16 outside of select and short-lived market shocks, but it does not stretch the imagination to consider at least a local trough in USD-skews around current levels if markets are entering a period of consolidation.

If we are correct on the pressure on mid-curve vol from partial unwinds of bearish dollar options and a temporary base in risk-reversals, overwriting 3M expiry OTM USD puts on cash dollar shorts is one way of reducing bearish USD exposure while still retaining partial exposure to the theme and collecting some handy premium in the process. Indeed, 2nd charts and 3rd chart show that USD put overwriting has been a useful risk-reduction strategy for short dollar portfolios over time, even if they have not necessarily proven to be return enhancers in the mold of equity calls.

USD put overwritten short dollar portfolios experience an improvement in average return/drawdown ratios of between 50% -100% vis-à-vis cash dollar shorts depending on the currency universe, with benefits most acute for EM FX that are most equity-like in terms of vol risk premium, and where the heavy hand of central bank intervention often constrains runaway currency appreciation.

At current prices, USD puts/G10 calls ex-GBP and JPY are relatively more expensive compared to USD puts/EM calls largely due to the run up in EURUSD and EUR-bloc vols over the past two months, and accordingly are the best overlays for a short dollar portfolio. Courtesy: JPM

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios