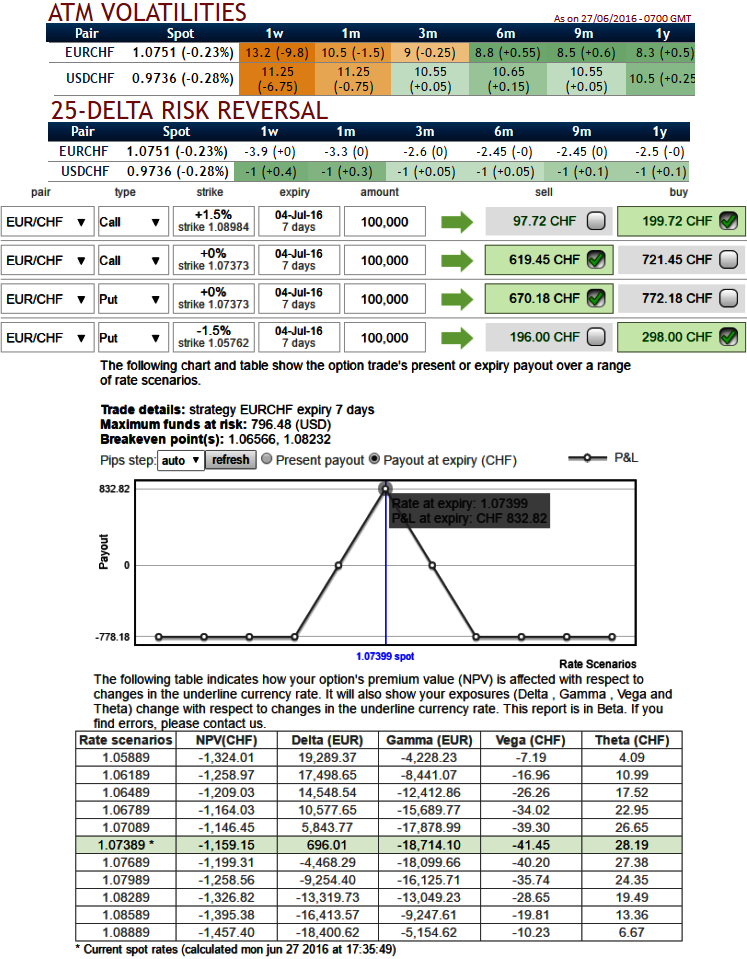

We spot out the massive drops in 1w-3m IVs, 13.2% in 1w expiries and 9% in 3m tenors, while risk reversals favor bulls in Swiss franc for which SNB is unhappy with.

Since the minimum exchange rate in EURCHF was abolished interventions have become part of the SNB’s everyday repertoire.

The way we like to yield the advantage by trading implied volatility is through iron condors.

With this trade, you are selling an OTM Call and an OTM Put and buying a Call further out on the upside and buying a put further out on the downside.

Let’s look at the instance shown in the diagram and ponder over where we place the following trades today gauging IV shifts.

To execute an iron butterfly, as shown in the diagram the options trader can initiate a lower strike OTM put, sells a middle strike an ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call, this results in a net credit to put on the trade.

The iron butterfly spread is a limited risk, limited profit trading strategy that is structured for a larger probability of earning a smaller limited profit when the underlying spot FX is perceived to have a low volatility.

The sensitivity tool also consists of the payoff diagram for the trade mentioned above straight after it was placed. Notice how we are short vega of 41.45. This would imply that the net position will benefit from a fall in implied vols.

Please be noted that the tenors, strikes, and instruments shown in the diagram are just for demonstration purpose only, use appropriate inputs as suitable to your trading profile.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data