GBP has been a currency with substantial fundamental uncertainty for now in our view. One side Brexit transition and on the other hand, the abrupt change in the BoE’s reaction function triggered a sharp GBP rally in September. However, the trigger for the shift remains unclear and injects a greater-than-usual degree of instability to the path of UK monetary policy.

Politics remains a risk factor for the currency, both at a domestic level where speculation around PM May’s grip on the Tory party and a potential leadership challenge has increased and externally on the Brexit front where the risk of deadlocked UK/EU negotiations going into the December summit and a UK walkout has grown.

These risks are not mutually exclusive either, with a messy feedback loop from Brexit politics to BoE policy potentially exacerbating bearish currency pressures, widening the range of possible outcomes and imparting a fat left tail to the distribution. Yet current levels of GBP implied vols/skews price in almost no policy uncertainty premium.

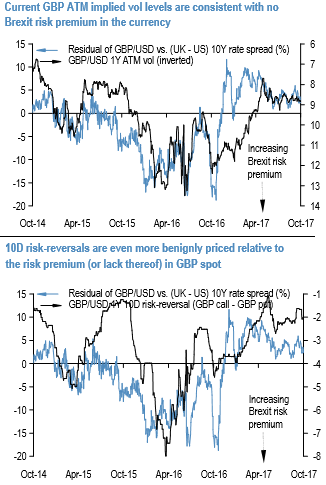

A simplistic pointer is that GBP ATM vols and skews have retraced more than 100% of their post-Brexit referendum widening from last year even as the pound has reset at a permanently weaker level. A more robust argument is that current GBP vol levels are consistent with zero risk premium in the spot, where the latter is measured as the undershoot relative to a pure interest rate based cyclical framework.

As per the above charts, it demonstrates, the risk premium for policy uncertainty in the currency – both in cash and in vol –is near zero, and this is surprisingly equally, if not more, true for low-delta risk reversals that generally act as reliable repositories of tail risk premium. Thus, it is reckoned that the UK policy uncertainty inadequately priced into GBP options. Courtesy: JPM

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data