Retail sentiment has taken a shift, especially after the election, as more retail investors expect the Indian stock market to outperform, especially after the massive election victory by Prime Minister Narendra Modi-led Bharatiya Janata Party (BJP) government, just like the last time in 2014, when Mr. Modi became the Prime Minister for the first time with a sweeping victory.

However, this time is not last time and indications so far suggest that this time could actually be different, at least in the short run.

- The U.S. benchmark stock index that exerts influence across the globe is down for the fourth consecutive week and breaking into lower lows. This is not a suitable condition for the bulls even in India and despite the news.

- Moreover, the shift in retail sentiment at a time of global stock market rout should not be ignored. To gauge retail sentiment, one of the most popular indicators is often used - put/call ratio (PCR).

- The Nfty50 PCR is currently at 0.82, which suggests that the retail segment of the market are more active on the call side, suggesting that the index might actually move lower.

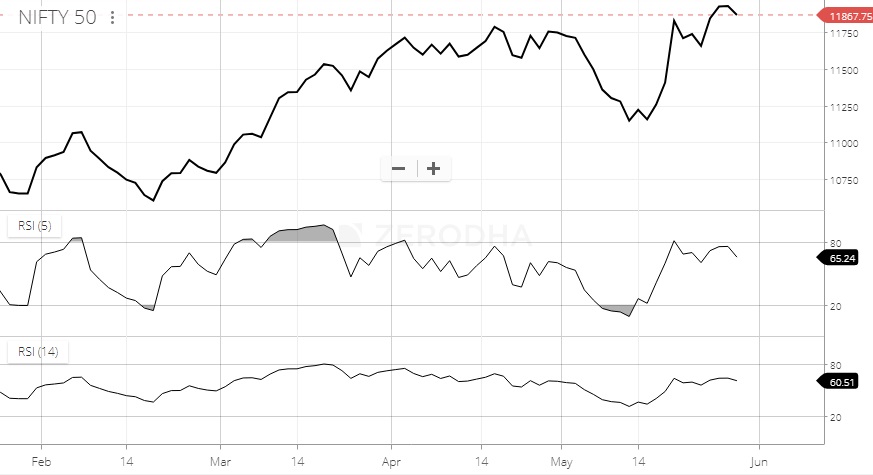

The index is currently trading at 11875, down 0.45 percent for the day. Key supports likely to get tested at 11650, 11575. If the rout in global stock markets continues, the index likely to retest 11300 area.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX