Higher oil price coupled with a costlier dollar amid a dollar liquidity drain from the global financial system have finally started taking its toll on India’s foreign exchange reserve, which according to the data from RBI is declining at the fastest pace since the 2013 currency crisis, which pushed the Indian rupee to record low against the USD. The good news is that the current forex reserve of India remains significantly higher than it was back in 2013.

Since reaching the record high of almost $425 billion in April this year, the forex reserve is down almost $20 billion to $405.1 billion as of 13th July, which is the lowest since December 2017. While one can take respite in the increased size of the forest reserve, which is almost 40 percent higher than it was in 2013, nevertheless the pace of decline is alarming.

The key reasons behind India’s 2013 currency crisis were twin deficits; current account deficit and budget deficit. So, it is important to note that while forex reserve has ballooned since the 2013 crisis, the fundamental hasn’t changed much. While the government was able to reduce the budget deficit from 4.5 percent in 2013, it is still running a deficit of 3.5 percent of GDP.

In addition to that, India’s balance of trade once again recorded a $16.6 billion deficit in June 2018, which is the highest number since 2013.

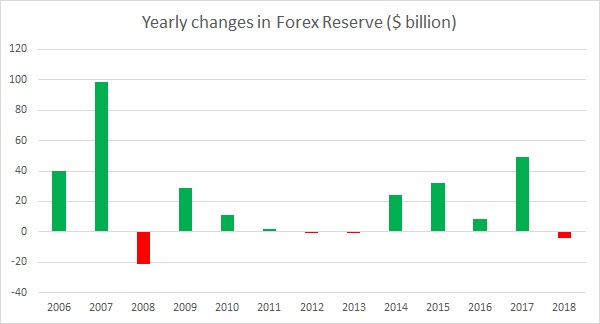

The chart shows that after a strong build-up since 2015, India's forex reserve has experienced a net outflow of $4 billion, so far in 2018, which is the biggest outflow since 2008 financial crisis.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX