Better than expected economic numbers and expectations that China would once again avert the much forecasted economic slump have pushed the iron ore price to the highest level since March this year. China’s recent announcement to review the scrap imports has also played its part in the rise in price.

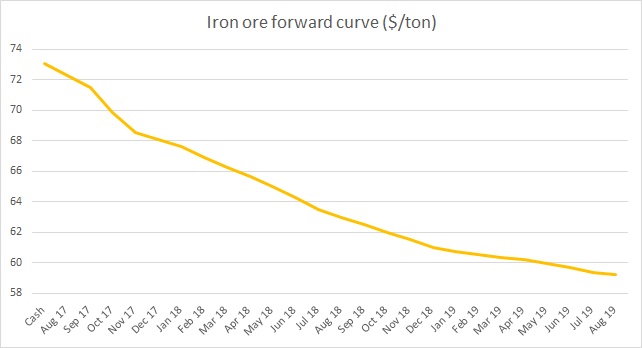

The cash price in iron reached $73 per ton, which is the highest level since March when the price was in decline from its February peak above $90 per ton. However, the iron ore market remains deep in backwardation which indicates that there is a shortage of supply in the cash market, while the market is expected to remain well supplied in the future. The price differential between the cash and the August next year future remains as high as $11 per ton.

The increasing price of iron ore is likely to drive up the price of steel and would also be pushing inflation higher across the world. It is likely to benefit both the top and bottom line of companies like BHP Billiton and Rio Tinto and support the strength of the Australian dollar since iron ore is the single most important export commodity of Australia.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX