Sterling bearish pressure still remains intact and has fallen more than 15% so far in trade-weighted terms since 23rd June.

A raft of UK data releases later this week, including CPI, labor market statistics and retail sales, would probably play the second swindle to politics. GBPAUD at the current juncture is mounting with huge bearish pressures.

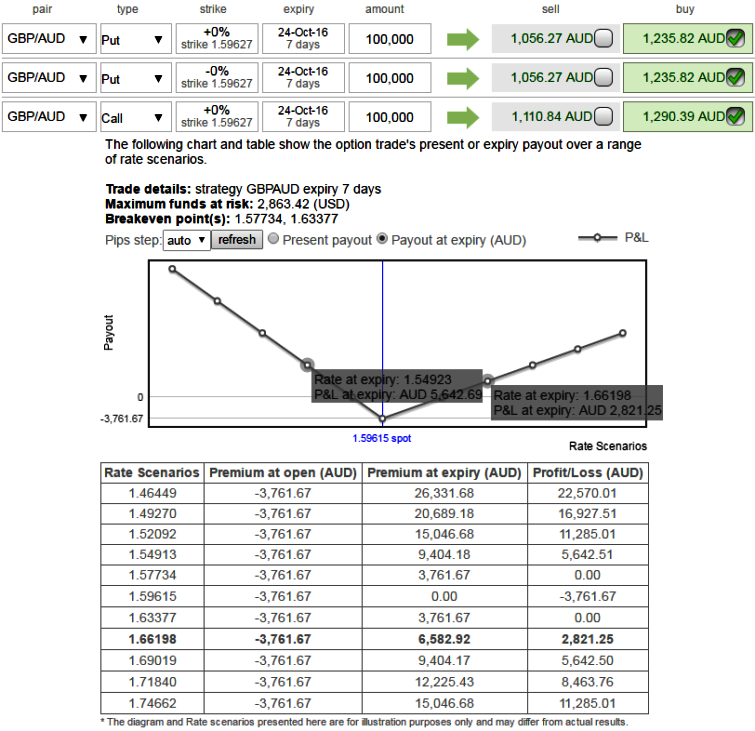

How to execute the strategy: Add longs in 2 lots of ATM -0.49 delta puts and 1 lot of ATM +0.51 delta call option, both side should have similar expiries.

Scenario 1: What if GBPAUD keeps declining:

Both ATM legs of two puts to become in the money. The puts we deploy were not very far off from the ATM strike and with handsome delta values. In terms of %age they would increase very fast as the spot FX keeps dipping. The call would decrease in value and goes worthless.

A 100 pips downward movement could bring in good profits (see left-hand side payoff table). You are already making good profits from the puts.

When you close positions on call before expiration and you would still get a premium but lesser than paid on account of the time value of money.

Result: Not a big loss from the call, and great profits from the puts as result of more proportion of puts (1:2) it gives leveraging effects to the portfolio.

Scenario 2: What if underlying stays in range:

When spot FX remains between strikes of 1.5773 & 1.6337, these two levels would serve as the break even points.

The current implied volatility of ATM put with a delta of -0.49 and1W ATM call with a delta of 0.5 is above 12%. Since 1W ATM IVs of this pair have also been higher with positive skews; any small change in underlying would lead exponential premium growth in the above instruments but are unlikely to fetch adverse results.

Usually whatever movement has to come it comes in near term (3-4 days per say) after any significant news.

Then the news dies down and normal trading begins. Which indirectly means there is no point in waiting after those 3-4 trading days. Sell all options bought and book loss/profits.

Scenario 3: What if underlying moves up:

The call option would be ITM but seems unlikely at this juncture. Because it has a healthy delta, premiums would spike faster but underlying spot should move substantially to show remarkable results. The two put options bought will lose value fast, but this call option would be bringing in profits. Since its only 1 lot, you may have to wait for some time to book profits, unlike puts.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure