On-going euro turbulence: The main risks events are now in Europe (ECB in September, Italian referendum, immigration tensions) and in the US (Jackson Hole, presidential election): this should support EUR/USD volatility.

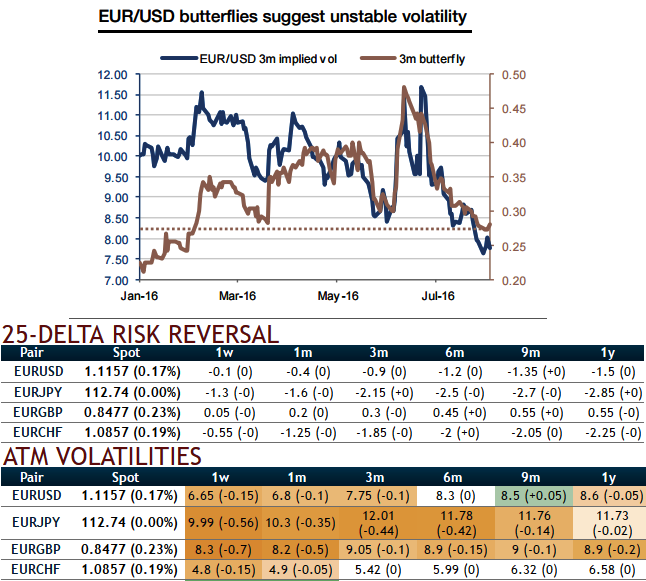

As the delta risk reversals of euro crosses have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Italy’s upcoming referendum on constitutional reform is not akin to Brexit, Prime Minister Matteo Renzi said in an interview on Monday.

Italy has its own referendum coming up in October, one which premier Matteo Renzi has staked his leadership on. But why might this vote have a worse impact on the EU than Brexit?

Although it’s more relevant to political aspect, much like Brexit in the UK, the referendum is increasingly being seen as a way for Italians to air their general discontent with the establishment, in large part because Renzi swore that he would leave politics if the referendum did not go his way. If he loses his gamble, the results of the referendum could have vast consequences for Italy and the whole of Europe that in turn adds extra risks to the euro in long run.

While, the 3m vol has broken its lows to reach 2014 levels, but interestingly butterflies have not even fallen to the 2016 lows (see graph and nutshell showing RR & IVs). EURUSD IVs are substantiating the swings so as to suitable for butterfly spreads.

The smile suggests that the options market expects some volatility instability, which means unexpected spot deviations.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts