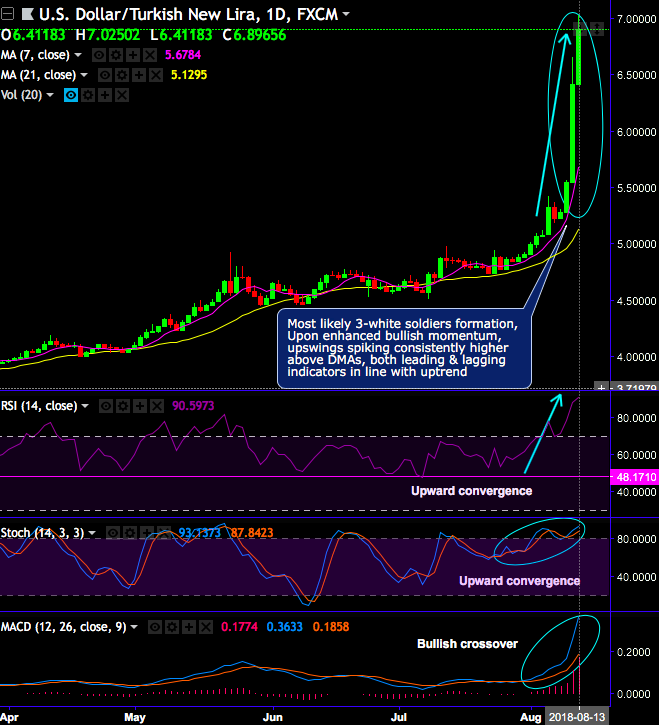

USDTRY is spiking and establishing swiftly new all-time highs day-by-day owing to a robust dollar outlook and new sanctions imposed on Turkey’s government. The pair has started bouncing from the lows of 5.2161 level to the recent highs of 7.0250 levels (refer daily technical chart). The bullish streaks have continued today as well. The lira continues its freefall despite Erdogan’s attempts to buoy the economy.

For the lira to stabilise on a sustainable basis President Recep Tayyip Erdogan would have to change tack in a radical manner. However, sadly it does not look as if that was going to be the case.

While the value in gamma selling appears less appealing on the back of deteriorating risk sentiment but realized vol still looks too bearish to turn the page on gamma selling just yet with early bettors on mean-reversion risking to incur significant intra-life theta bleed.

This extreme volatility not only presents an opportunity – but it is causing parallel movements in both the EUR and Asian Stocks – due to these markets’ tight connections with Turkey’s faltering economy.

Realized vol continued to weigh on more than half of the 4 long gamma returns (refer 1stchart). Despite the global vols 2016 taking a leg higher amid deteriorating risk sentiment we are wary of calling a reversal just yet with the summer calendar still in full swing.

At multi-year highs, EM-G10 spread (3vols) is not showing signs of abating as idiosyncratic developments (TRY exploding +15vols and RUB edging higher +2.5vols since last week) are keeping EM vols firm.

The portfolio of short front vs long back tenor EM vol calendars came under pressure but now we see increased risks from a more systemic turn for the worse. Dark clouds are starting to throw a shadow over gamma selling.

However, the tension between optically wide implied- realized vols and souring risk sentiment, a familiar conundrum for option investors, is one that tends to eventually resolve in the direction of higher vols but with significant intra-life theta bleed for early bettors on mean-reversion.

At spot reference: 6.8869 levels, contemplating above driving factors, on hedging grounds we initiate RV trade - 3m USDTRY call option, short 1m put. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown 58 (which is bullish), while articulating at 13:26 GMT.

For more details on the index, please refer below weblink:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch