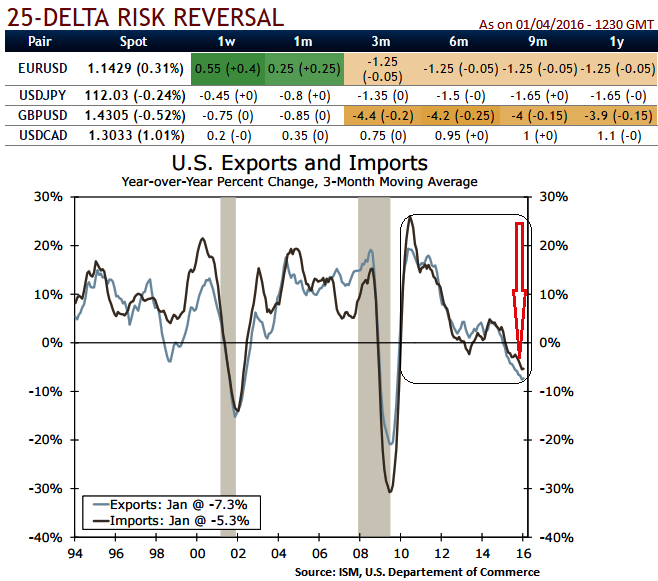

Tuesday, International trade data release is scheduled that is likely to weigh on U.S. economic growth in January as demand for U.S. goods and services was depressed by economic weakness abroad and the strong U.S. dollar.

Activity slowed for both imports and exports on a year-over-year basis, although the broad-based decline in exports was more pronounced, widening the total trade deficit to -$45.7 billion in January from -$44.7 billion in December.

The February advance trade in goods report, released earlier this week, shows a slight monthly increase in both the export and import of goods, with little change in the deficit.

While, glancing on risk reversal nutshell of dollar crosses, indications from FX OTC markets are that except sterling, dollar losing streak is anticipated and continued to hedge against euro and yen for downside risks but stagnant against Canadian dollar.

So, these risk reversals evaluate the volatility paid on out of the money calls against out of the money puts. An aggressively out of the money (OTM) option is often seen as a speculative bet/hedge that the currency will move sharply in the direction of the strike price.

We, at FxWirePro, expect February’s final report to look similar as global weakness continues to weigh on domestic demand.

Stronger domestic demand also helps lessen the detrimental impact of a strong dollar on the US tourism industry, as the number of overseas visitors declines significantly because the higher greenback makes it more expensive to travel to the US and vacation there.

Currency gyrations have the biggest impact on international trade, making imports cheaper and exports more expensive. Over time, a stronger US dollar will serve to widen the trade deficit, which will gradually exert downward pressure on the greenback and pull it lower.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed