Euro dropped about 2.93%, from the last month’s highs of 1.1327 to the current 1.0995 levels.

Longer term, security and political risks should weigh on the euro going forward: the Italian senate reform referendum this month, Italian and Austrian elections in December, and Dutch, French and German elections in 2017.

A constitutional referendum is planned to be held in Italy on Sunday 4 December 2016. Voters are to be asked whether they approve of amending the Italian constitution to transform the senate of the republic into a "Senate of regions" composed of 100 senators mainly made up of regional councillors and mayors. Italians seem to have their say on Prime Minister Matteo Renzi and the economy isn’t doing him any favors.

M5S is the most popular political party in Italy, according to a poll by the Demos Institute in July. As an anti-EU party, M5S wants to hold a referendum over whether Italy should leave the euro zone. If the constitutional referendum fails, M5S might take power and trigger the referendum. If Italy exits the EU, it would pose an existential threat to the European Union.

Moreover, there also remains the prospect of further easing measures from the ECB (for example a formal extension of QE beyond March 2017).

The market should now eye the next supports towards the bottom of the range at 1.0820 and 1.0530. Since January, the EURUSD has essentially been driven by the S&P realized volatility, while US short rates explain it only when the influence of equity volatility is removed.

Fed's fears would mean higher yields and vulnerable US equities (strong negative correlation), which implies higher S&P volatility, this leads to a lower EURUSD.

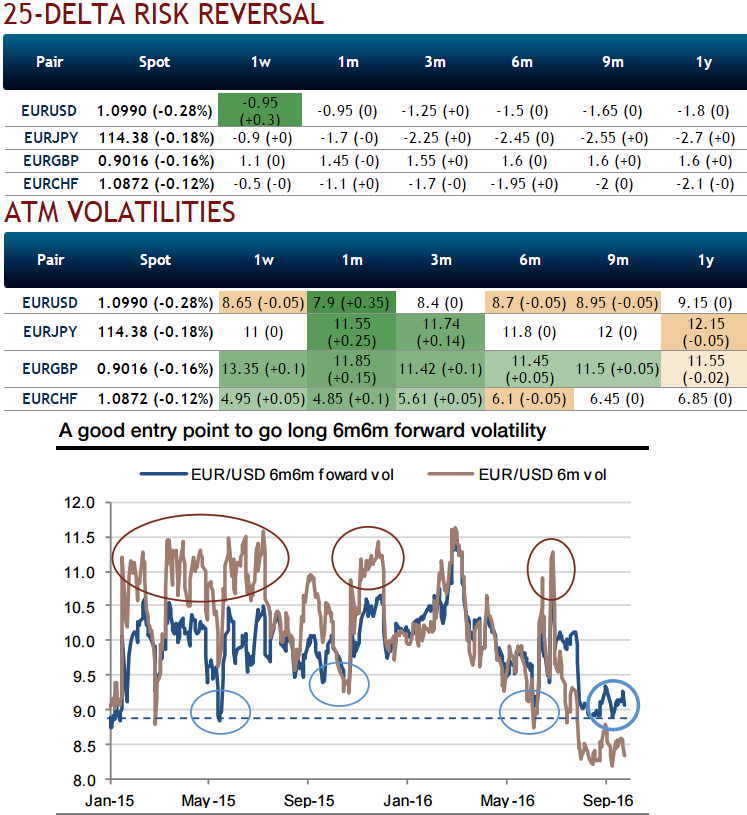

FX volatility entered a moderate regime in early 2015 but since July has come under significant pressure and is experiencing an unusually long period of stability. The current lows suggest multi-month volatility hedges, as in the medium term central bank activity will increase and political risk will stay high (US election, Brexit, EM “key man” risk).

These factors do not necessarily suggest that volatility is going to rise imminently, but it could become more supported over the medium term.

If the options market starts sharing this belief, volatility curves will tend to steepen in their vega segment. It is, therefore, attractive to consider buying multi-month forward volatility.

We continue to expect the euro to tick higher into 2017 despite Fed tightening, particularly given the ECB's misgivings about its QE programme.

As you can observe that there is no significant change in the above nutshell evidencing risk reversals and implied volatilities of longer tenors even though the forecast profile is little changed from the trajectory we proposed several months ago, so Q4 - 1.08, in case, Fed disappoints Q1’2017 - 1.14, and Q2’2017 - 1.17.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022