The Japanese yen is again at the mercy of developments in the US-China trade conflict. We are skeptical about current JPY weakness, as a long-term resolution of the conflict is unlikely and fundamental appreciation pressure is likely to increase.

Given the challenging domestic environment for returns, we think it inevitable that Japanese institutional investors will increase overseas investment through 2020 and beyond, shouldering the FX risk, and contributing to net JPY selling. According to our estimates, foreign securities investment accompanied by JPY sales reached a record high of JPY15.6 trillion in 2018. In 2019, activity was sluggish before the Golden Week holiday, which was unusually long. But since May, we estimate that the monthly average has reached JPY1.6 trillion, with an annual rate of JPY19 trillion. JGB yields below 10 years have mostly remained negative this year, and for US and German 10-year government bonds, hedging foreign exchange risk has resulted in negative carry.

We expect USDJPY to continue to trade in a relatively tight range, with the risk that if JPY moves sharply, our bias is in favor of yen weakness. Indeed, we noted above

that JPY and USD tend to move in the same direction on shifts in market sentiment.

The hurdle for a significant break out of this range thus seems to be high given stable US-Japan interest rate differentials, which remained highly correlated throughout 2019, as well as the Yen’s relatively low beta to easing expectations as priced by Fed Funds

futures.

If 2020 is a year in which the reflation trade becomes as dominant as in 2017, NEER depreciation could be large. The decline could be even larger than in 2017, given that in that year, the JGB 10-year yield was positive, as was the carry from investing in FX-hedged 10-year US treasuries. We also note that Japan’s trade surplus was still around 1% of GDP. By contrast, Japan’s trade surplus will be essentially flat next year. Two other factors could contribute to sustained outflows, depressing the NEER:

JGB 10-year yields were still positive in 2017 and 2018, after the BoJ introduced its yield curve control policy. However, from early 2019, yields entered negative territory, and remained negative for the most part. This episode of negative rates has already outlasted that of 2016 when yields first dipped below zero; Japanese investors are finding themselves in an unprecedented period of negative yields.

Around JPY50 trillion of JGBs held by investors other than the BoJ is set to mature in 2020, against only JPY11 trillion yen of positive yielding ultra-long-term bonds.

Trade Recommendations:

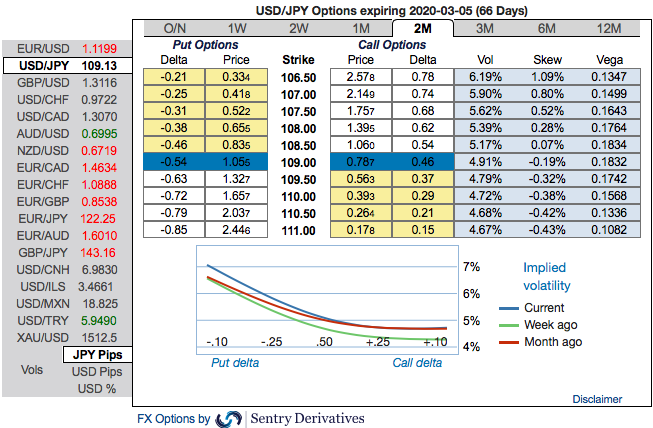

The positively skewed IVs of 2m tenors are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106.50 levels (refer 1st nutshell).

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks (2nd nutshell).

Hence, at spot reference of USDJPY: 109.123 levels, we advocate buying a 2M/2w 109.723/107 put spread (vols 5.10 vs 3.76 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we now like to uphold the same positions on the eve of festive season both Christmas and New Year, as the underlying spot FX likely to target southwards below 107 levels in the medium run.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms