Macro views:

We continue to maintain our bearish stances in this pair as the ongoing downtrend to prevail further as Japan produced healthy trade balance numbers, Japan recorded a 823.47 JPY billion surplus in April of 2016, compared to a 58.34 JPY billion deficit a year earlier and beating market consensus of a 492.80 JPY billion surplus.

It is the largest surplus since March 2010 as exports dropped by 10.1% YoY while imports shrank at a faster 23.3%.

But their manufacturing PMIs and industrial activity has reduced and missed the forecasts, PMIs were at 47.6 vs forecasts at 48.3. While, industrial activity missed the forecasts, prints at 0.1% vs 0.7%.

On the contrary, BoE’s inflation report hit back at UK referendum by stating that it’ll bring inflation back to target, whatever be the outcome of the referendum, sooner and more sustainably, Carney also stated that the next move in the key BOE interest rate would probably be up, while a Leave outcome wouldn’t automatically bring about an easing.

Whereas, the BoJ’s negative rate was probably the right decision, as without the move JPY could be much stronger.

GBP/JPY OTC FX Observation and Strategies:

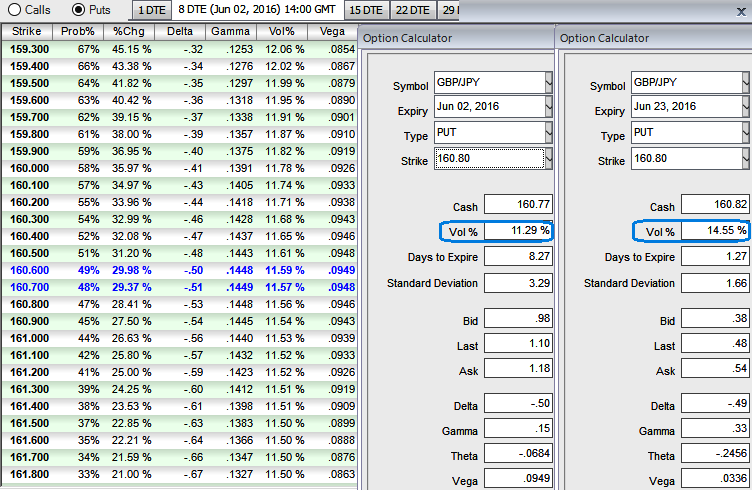

The implied volatilities of ATM puts of 1w expiries are at 11.29% and spiking higher at 14.55% for 1m tenor. 2W to 1M expiries are acting crazily in OTC markets, 11.82% and 14.55% respectively.

Gamma on OTM strikes is also progressively moving considerably, %change in option price is ticking higher positive figures and in an exponential speed as the underlying pair evidencing reducing momentum in previous upswings for the day.

So, if you expect that minor spikes in GBPJPY and would tumble thereafter, then the upswings offered by bulls is the right times for shorts in puts with shallow ITM strikes and shorter expiries.

Well, then here comes the right strategy to tackle these type of swings, “bull put spread” at net credits, buy next month +1% Out of the money -0.5 delta put option. Simultaneously, short 1W (-1%) in the money put with positive theta.

But, on hedging grounds initiate longs on 2 lots of 1M At-The-Money -0.49 delta puts that would function effectively in considerably higher IV times (see sensitivity table for higher probabilities and stabilized Vega growth). Simultaneously, deploy shorts side of 1 lot of 1M (0.5%) ITM put option. The net delta should be around 44% and the positions could be entered with reduced debit.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX