Here are some key charts based on data from United States’ Energy Information Agency (EIA) that explains the level of inventories, refinery demand, and production.

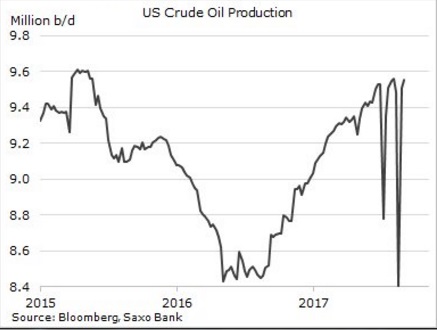

- Chart 1 shows crude oil production in the United States which rebounded sharply from 8.41 million barrels per day to 9.55 million barrels per day as the Hurricane effect fades.

- Chart 2 has been making the refiners around the world cheer and filling OPEC with joy as it shows that distillate inventories have declined significantly and fallen below 5-year average. It is at 128.921 million barrel, down more than 50 million barrels since the beginning of the year and down 0.32 million barrels from the previous week.

- U.S. oil imports have been declining over the past couple of year. Chart 3 shows that imports have fallen well below 5-year average thanks to the hurricane season and devastating effects of Harvey, Irma, and Nate. It is showing signs of a rebound. However, last week, imports declined to 7.571 million barrels per day, down from 8.123 million barrels in the previous week.

- Chart 4 shows the level of U.S. crude oil exports, which has reached a new record high of 2.133 million barrels per day, up from 1.924 million barrel previous week.

- Chart 5 shows U.S. refinery demand, which suffered a major blow during Hurricane Harvey and the like of Hurricane Nate is stabilizing. Hurricane Nate. Yesterday’s report shows it at 16.015 million barrels per day.

- Chart 6 shows the level of crude oil inventories, which has declined around 81 million barrels since March to 454.9 million barrels.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX