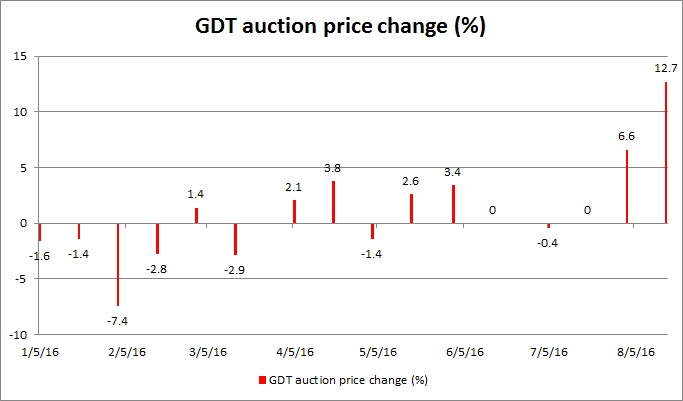

This year, the price of the dairy, which is the major export commodity of New Zealand, has been recovering. In the last two auctions, the price has moved higher by 6.6 percent and 12.7 percent. While this has been supportive of the kiwi, the dairy farmers couldn’t lock in all of the gains due to rise in the value of the exchange rate.

The New Zealand dollar is currently trading at 0.734 area and if the dairy auctions turned out to be a good one, the kiwi is likely to clear off the resistance zone around 0.73 area decisively.

Trade idea: We expect the New Zealand dollar to trade strong against the USD. Making a base around 0.7 area, we expect the kiwi to move towards 0.8 area against the dollar. The rally may get extended towards 0.82.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022