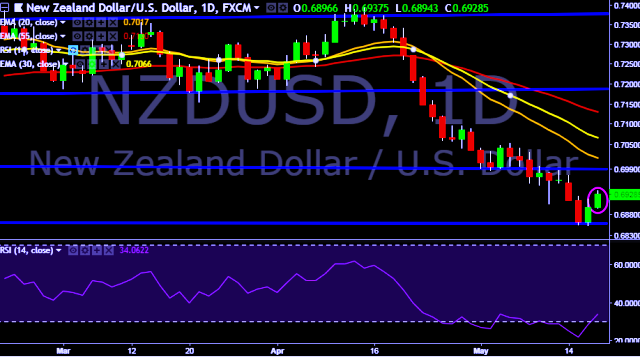

- NZD/USD is currently trading around $0.6930 marks.

- Pair made intraday high at $0.6937 and low at $0.6894 marks.

- Intraday bias remains bullish till the time pair holds key support at $0.6851 marks.

- A daily close above $0.6896 mark will drag the parity higher towards key resistance around $0.6981, $0.7047, $0.7095 and $0.7157 marks respectively.

- Alternatively, consistent close below $0.6896 will drag the parity down towards key supports around $0.6851, $0.6809, $0.6736 and $0.6676 marks respectively.

- New Zealand Jan forecast increase to 3.14 bln nz vs previous 2.54 bln nz.

- New Zealand Jan net debt forecast decrease to 20.8 % vs previous 21.7 %.

- New Zealand Jan budget cash balance increase to -1.25 bln nz vs prev -2.65 bln nz.

- NZ sees 2018/19 GDP +3.8 pct.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest