The GDT dairy auction resulted in an overall price decline of 3.9%, with whole milk powder down 2.5% (futures markets had predicted a 4% rise).

New Zealand current account deficit narrowed to NZD 4.68 billion in the Q3 of 2017 from NZD 4.97 billion a year earlier. It was the smallest gap for any Q3 in two years. The services gap narrowed to NZD 0.05 billion from NZD 0.17 billion a year earlier. The primary income deficit widened to NZD 2.38 billion from NZD 2.03 billion.

Meanwhile, the secondary income deficit narrowed to NZD 0.09 billion from NZD 0.17 billion. The annual current account deficit was NZD 7.1 billion or 2.6 percent of GDP for the year ended September of 2017 (vs 2.7 percent of GDP for the year ended September 2016).

NZDJPY has been oscillating between a range of 83.910 and 75.626 levels since mid-November 2016 and we foresee to continue the same range.

While Japan has posted in the recent a JPY 113.4 billion trade surplus in November of 2017, following a JPY 146.5 billion surplus a year earlier and beating market expectations of a JPY 55 billion deficit. Exports jumped 16.2 percent year-on-year, above forecasts of a 14.6 percent rise, with sales to China hitting a record high value. Imports were the highest since July of 2015.

With these trade figures, the base case scenario is foreseen for another quarter or so in a narrow range, with NZDJPY 83.910 and 75.626 likely to capture the range for Q1’2018. Suppose any break-out of NZDJPY 79.490 does, however, seem almost inevitable once the BOJ signals a change in policy and is more likely on any time-scale than a sustained move above NZDJPY 83.780 levels.

The appointment of Orr as the new RBNZ governor generated huge relief for a market that had grown pessimistic about the new Labour-led government’s economic policies.

OTC Outlook and hedging strategies:

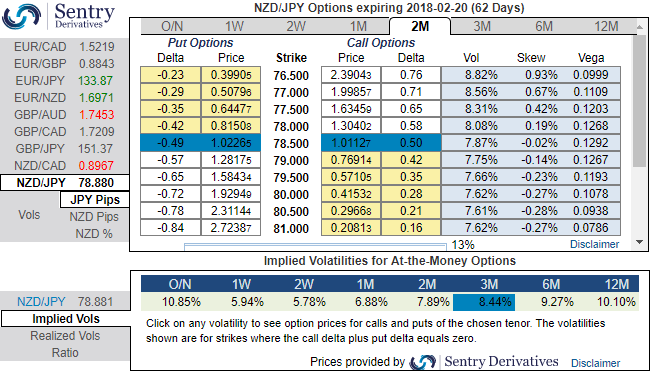

ATM IVs of NZDJPY is trading between 6.13% and 7.94% for 2w and 2m tenors respectively and positively skewed IVs of 2m tenors are evidencing bearish hedging interests. Bids for OTM puts upto 76.50 is noticeable to signify downside risks.

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.46. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 2m IVs & RR to buy NZDJPY ATM -0.49 delta put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -31 levels (which is bearish), while hourly JPY spot index was at -89 (bearish) while articulating (at 07:58 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data