For those who don't like to accumulate either existing shorts on EUR positions or not longs dollar side with minimal delta terms, instead, better to take long term neutral positions such as option butterflies. We have some smart trading arrangements; these can even be utilized in our model the assortment of portfolio until the better clarity on how these global factors (especially Greece on euro side & Fed's decision on dollar side) will play out.

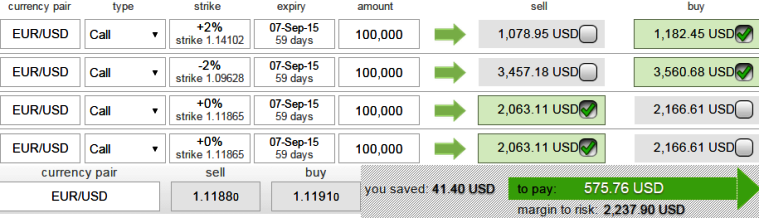

Therefore, buying 2M (+2%) Out-Of-The-Money (strikes at 1.1412) 0.34 delta call, buy another 2M (-2%) In-The-Money (strikes at 1.0964) 0.67 delta call and simultaneously sell 2 lots of 2M At-The-Money calls with positive theta values. All the positions should be early September maturities. As the delta on butterflies would usually be zero, this option combination should also be close to zero.

We reckon, this butterfly spread is best suitable and enables market laggards, risk averse traders, speculators who've been bias on both Fed's hike news and Grexit matters to participation in market turbulence as it brings in limited returns and limited risk.

Hedgers whose is neutral on irrespective market making matters but involved with their international business, this would arrests systematic risks.

Long butterfly spreads are entered when the investor thinks that the underlying exchange rate will not rise or fall much by expiration. One additional long position would result in net debit.

FxWirePro: Laggards who expect Fed’s hike in September hedge EUR/USD using long butterfly

Friday, July 10, 2015 12:33 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate