We have upgraded the risk bias around the forecasts from CHF negative to neutral. The pair (USDCHF) has been oscillating between 1.0060 – 0.9560 levels from the last couple of months. This long-lasting tight range-bounded major trend likely to prolong further.

OTC Updates and Options Strategy:

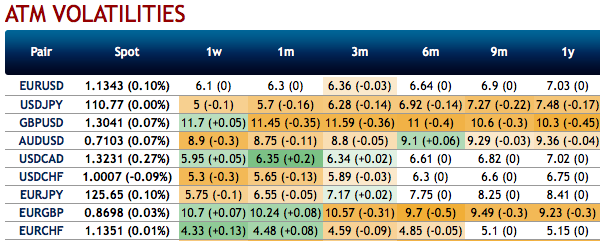

Amid the tepid underlying spot FX movements, let’s just quickly glance through above-implied volatility (IV) nutshell before deep diving into the strategic frameworks of USDCHF. CHF crosses are showing the least IVs among G10 FX bloc (1m IVs are at 5.65 and 4.48 for USDCHF and EURCHF respectively).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility.

Ascertaining future volatility accurately is almost impossible for any FX veteran. Nevertheless, computing the marketplace’s expected future volatility is quite feasible using the option’s price itself which is known as implied volatility (IV).

The execution of options trading strategy: Contemplating above rationale, the recommendation would be on buying (2w) OTM 0.39 delta call while simultaneously shorting ATM call with similar expiries and buy ITM 0.79 delta call while simultaneously shorting an ATM call with similar expiries.

The rationale: The positively skewed IVs of 2w tenors are stretched on either side, and the underlying spot movement is wedged in a tight range.

Contemplating the above factors, this strategy is structured for a larger probability of earning smaller profitability but certain profit as USDCHF is perceived to have low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which the call and put options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

Risk/Returns Profile: The maximum return occurs at ATM strike. A smaller return is made between ATM strikes and the break-even points. The maximum loss is limited by OTM strike prices.

Effect of Volatility: The value of the options will decrease as volatility decreases, which is usually conducive for the strategy. An increase in volatility will be generally bad for the strategy as stated above.

Effect of Time decay: The value of the option decays as each day passes (good). Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -9 levels (which is neutral), while hourly CHF spot index was at -88 (bearish), while articulating (at 11:47 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios