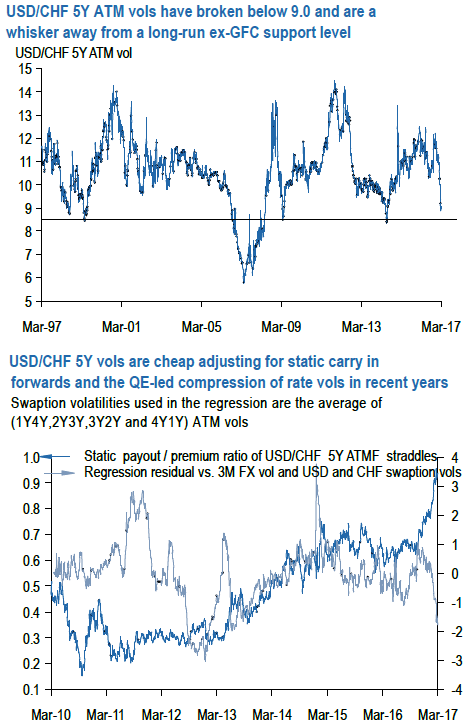

The back-end (5Y and out) USDCHF vol is beginning to approach deep value levels. While not quite through Q2’14 lows that we flagged in reference to USDJPY last week, 5Y ATMs have cratered in excess of 3 % pts and broken below 9.0 for the first time since that Great Moderation 2.0 period, and are a whisker away from a long-run ex-GFC floor (refer above chart). A few other valuation –related observations:

Adjusted for short-dated (3M) FX vol and blended (1Y4Y, 2Y3Y, 3Y2Y, 4Y1Y) USD and CHF swaptions vols, 5Y ATMs look ~1.5 pts. too low (refer above chart).

The result is robust to the inclusion/otherwise of illiquid CHF swaptions, and suggests that the decline in long-end FX vol has undershot the QE-driven compression of interest rate volatility.

Carry/vol ratios of 5Y ATMF straddles are the highest in the post-GFC era, helped by the widening US-Swiss rate gap over the past few years (refer above chart).

In fact, forward points are large enough now to almost cover the entire straddle premium, and USDCHF outranks every other G10 currency on this metric including traditional carry heavyweights such as AUD and NZD.

Carry in forwards aside, slide along the vol surface is the other significant component of overall option bleed; in this respect, the flattening of the 5Y- 1Y vol curve since last year (current +0.8 pts from 2 vols + in Q3’16) is helpful, though there is still some way to travel before hitting the pancake flat plateau of the pre-2007 years.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?