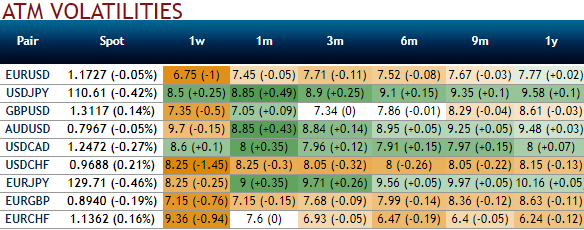

Please be noted that the OTC VIX for EURCHF has been the highest, but IVs of longer tenors have still been on the lower side, while risk reversals indicate the hedgers’ interests in the bullish risks.

With limited room for Euro appreciation and the near certainty of a vol slump in the event of a traditional party appear to prevail in German or Italian elections and ECB becomes more hawkish. long delta/short Vega strategies such as EUR call flies appeal, and are well-priced in EURCHF.

Higher leverage expressions of Euro strength are [EUR/CCY higher, USD/CCY lower] and [EURUSD higher, EuroStoxx higher] dual digitals.

EUR-crosses have historically displayed widely varying sensitivities to crash risk in the Euro, with EURHUF, EURPLN, EURAUD, and EURNZD all tending to rally during Euro-stress, and EURJPY, EURGBP and EUR/Asia selling off sharply.

Consider buying zero-cost combinations of low delta EUR puts in the latter camp funded with EUR puts in the former as conditional expressions of EUR crash risk.

Deep value is beginning to emerge in long-end (5Y) USDCHF vol.

Long/short pairs of USD calls/CHF puts funded with EUR calls/CHF puts are priced at multi-year lows and offer franc view-neutral positive carry.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand